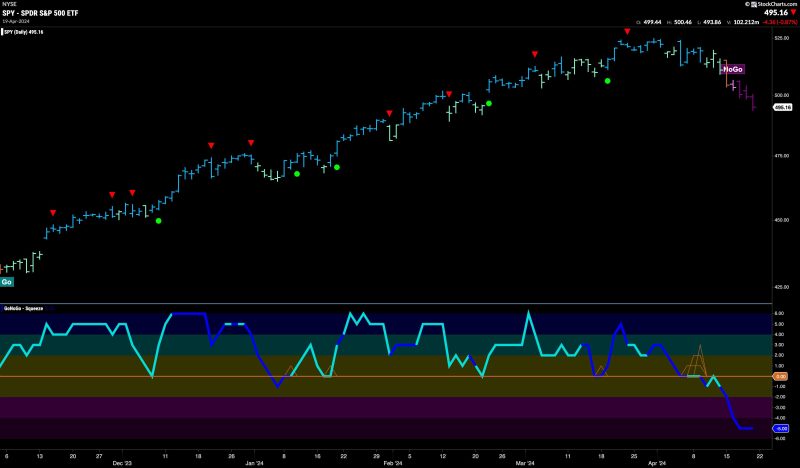

Equities Struggle in Strong No-Go as Materials Try to Curb the Damage

The global equities market is currently experiencing a period of struggle as various factors come into play. Investors are facing uncertainties and challenges as they navigate through a volatile landscape. In the midst of this turmoil, the materials sector stands out as it attempts to curb the damage and provide some stability.

One of the key reasons behind the equity market’s struggles is the prevailing strong No-Go sentiment. This sentiment reflects the cautious approach taken by investors, who are wary of potential risks and uncertainties in the market. As geopolitical tensions rise and economic indicators fluctuate, investors are opting to stay on the sidelines rather than making significant moves. This risk-averse attitude has contributed to the overall struggle in the equities market.

Within this challenging environment, the materials sector has been making efforts to withstand the pressure and minimize the damage. The materials sector encompasses a wide range of industries, including mining, metals, chemicals, and construction materials. These industries play a crucial role in supporting various sectors of the economy, making them essential components of the equities market.

Despite the overall bearish sentiment in the equities market, the materials sector has shown resilience in the face of adversity. Companies within this sector have implemented strategic measures to manage risks, reduce costs, and optimize operations. By focusing on efficiency and innovation, materials companies are striving to maintain profitability and sustainability in the current market environment.

Moreover, the materials sector is benefiting from certain tailwinds that are helping to offset some of the challenges it faces. For instance, the global demand for raw materials and commodities remains strong, driven by factors such as infrastructure projects, urbanization, and industrial growth. As a result, materials companies are able to capitalize on these opportunities and generate revenue despite the broader market downturn.

Additionally, advancements in technology and sustainability practices are reshaping the materials sector and providing new avenues for growth. Companies are increasingly investing in research and development to improve product quality, reduce environmental impact, and meet evolving customer needs. By embracing innovation and sustainability, materials companies are not only adapting to the current market conditions but also positioning themselves for long-term success.

In conclusion, while the equities market is currently facing challenges due to the strong No-Go sentiment, the materials sector is striving to weather the storm and maintain stability. By focusing on operational efficiency, risk management, and growth opportunities, materials companies are demonstrating resilience in the face of adversity. As the market landscape continues to evolve, the materials sector will play a crucial role in shaping the future of the equities market and driving economic growth.