In a recent analysis by financial experts, a concerning weakness in a key index has raised alarms among investors about the possibility of a broader market correction. The focus on this particular index, known as the Jones Index, stems from its historical significance as a reliable indicator of overall market health.

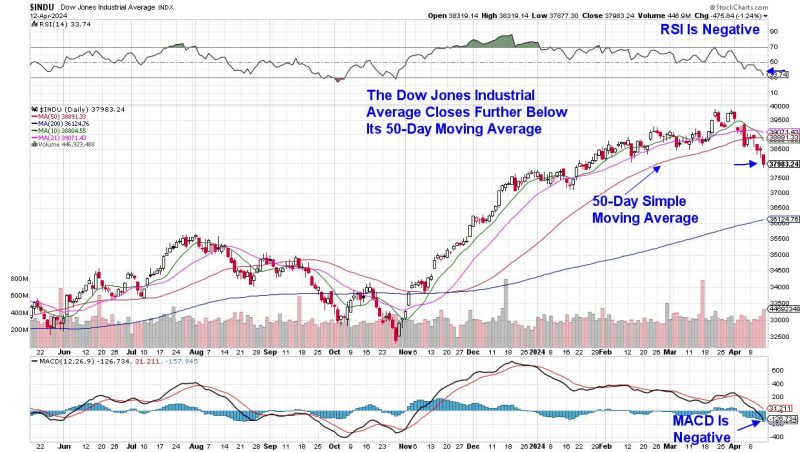

The Jones Index, which tracks a diverse range of stocks across various sectors, has exhibited signs of weakness in recent weeks. Analysts have pointed to several contributing factors that have led to this decline, including uncertainties surrounding global trade tensions, geopolitical risks, and potential interest rate hikes by central banks.

One of the primary concerns highlighted by market observers is the potential impact of these factors on corporate earnings. As trade tensions persist and geopolitical risks escalate, companies may face challenges in maintaining profitability and growth, which could negatively affect stock prices across the board.

Furthermore, the prospect of interest rate hikes by central banks has also weighed on investor sentiment. Higher borrowing costs could dampen consumer spending and business investment, further impacting corporate earnings and stock performance.

The weakness in the Jones Index has sparked fears of a broader market correction among investors. A prolonged downturn in this key index could signal a shift in market sentiment and serve as a leading indicator of a larger market correction.

In response to these concerns, investors are advised to closely monitor developments in the Jones Index and other key market indicators. By staying informed and proactive, investors can position themselves to navigate potential market downturns and make strategic decisions to protect their portfolios.

Ultimately, the weakness in the Jones Index serves as a reminder of the inherent risks and uncertainties in the financial markets. While market corrections are a normal part of the investment landscape, staying vigilant and informed can help investors weather potential storms and capitalize on opportunities that may arise in the wake of market downturns.