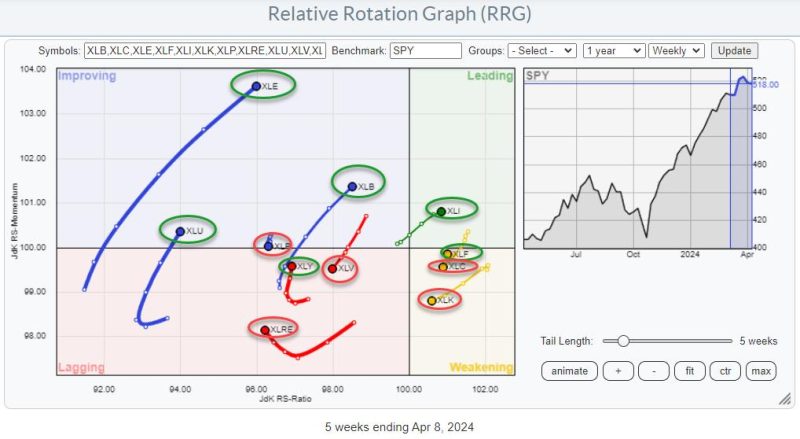

Rapid Return Generator (RRG) Indicates that Non-Mega Cap Technology Stocks are Improving

The Rapid Return Generator (RRG) has become a popular tool for investors to analyze stock performance and identify trends. In recent times, the RRG has indicated that non-mega cap technology stocks are showing signs of improvement, prompting both seasoned and novice investors to take a closer look at this sector.

Non-mega cap technology stocks refer to companies that are not classified as large-cap or mega-cap within the technology industry. These companies often have a market capitalization that falls below the billion-dollar mark but demonstrate strong growth potential and innovative products or services.

The RRG tool works by plotting individual stocks or sectors on a graph based on their relative strength and momentum. Stocks that are positioned in the Improving quadrant on the RRG graph are considered to have strong relative momentum and are potentially well-positioned for future growth.

For non-mega cap technology stocks to be showing improvement on the RRG, there are likely several key drivers fueling this positive trend. One factor could be increasing demand for niche technology products or services offered by these companies. In today’s fast-paced digital economy, there is a growing demand for specialized technology solutions catering to various industries and consumer needs.

Furthermore, non-mega cap technology companies are often perceived as more agile and innovative compared to their larger counterparts. These companies can quickly adapt to market changes, introduce new products, and capitalize on emerging trends, which can be reflected in their stock performance.

Investors keen on capitalizing on the improving trend of non-mega cap technology stocks based on the RRG analysis should conduct thorough research and due diligence. While the RRG provides valuable insights into relative strength and momentum, it is crucial to consider other fundamental and technical factors before making investment decisions.

Diversification is another important aspect to keep in mind when investing in non-mega cap technology stocks. By spreading out investments across multiple companies within the sector, investors can mitigate risks associated with individual stock volatility and potentially maximize returns.

In conclusion, the RRG indicating that non-mega cap technology stocks are improving serves as an encouraging sign for investors looking to explore opportunities in this sector. By leveraging the insights provided by the RRG and combining them with comprehensive research and sound investment strategies, investors can position themselves for potential growth and success in the dynamic world of technology stocks.