In the fast-paced world of finance, keeping a close eye on market movements is crucial for investors seeking to navigate the unpredictability of global markets. This week is particularly interesting as we delve into the intricacies of the Nifty index and explore its potential implications on the broader market landscape.

Starting off, the Nifty index has been a significant barometer of market sentiment in the Indian stock market. As we analyze the recent movements, we see a trend of modest gains followed by intermittent periods of consolidation. This pattern suggests a cautious optimism among investors, as they navigate through uncertainties surrounding geopolitical events and economic indicators.

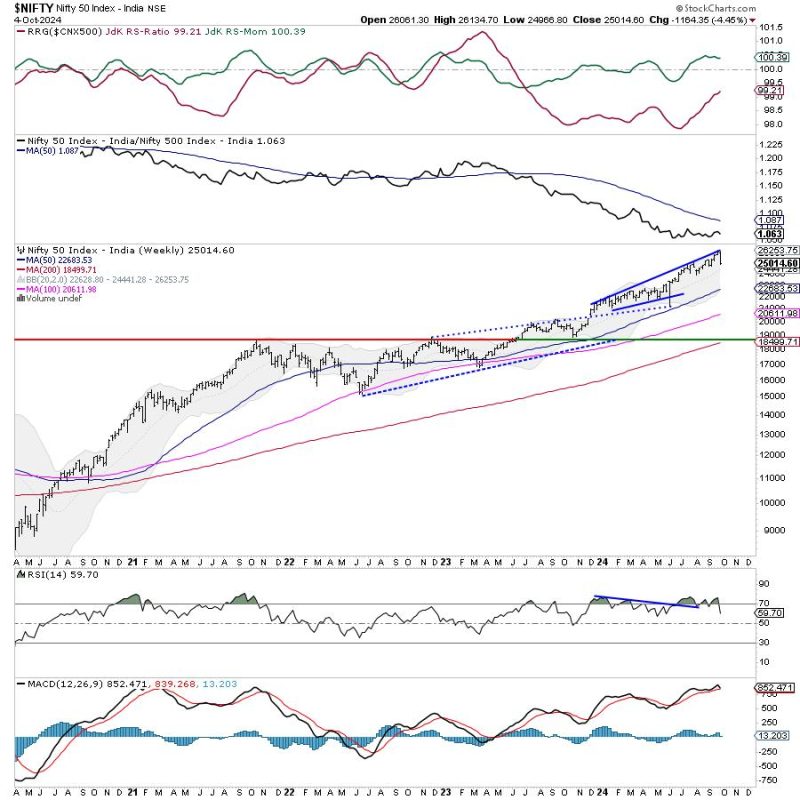

Zooming in on the technical aspects, the Nifty’s performance in key support and resistance levels is worth monitoring closely. These levels provide valuable insights into potential price reversals and turning points, guiding traders in making informed decisions. A breach above or below these levels could signal a shift in market direction, prompting investors to adjust their strategies accordingly.

Moreover, the broader market trends are also significant factors to consider when gauging the Nifty’s trajectory. The interplay between global economic conditions, sectoral performances, and market volatility can influence the index’s movements in ways that are not immediately apparent. Therefore, a holistic approach to market analysis that takes into account these various elements is essential for accurately forecasting market movements.

In addition to technical analysis, sentiment indicators play a crucial role in understanding market dynamics. Investor sentiment, market breadth, and trading volumes can provide valuable clues about the underlying market sentiment and potential market shifts. Monitoring these indicators in conjunction with technical analysis can help investors gain a comprehensive view of the market environment.

As we navigate through the week ahead, it is important to maintain a balanced perspective on market movements. While short-term fluctuations may create uncertainty, a focus on long-term fundamentals and a disciplined investment approach can help investors weather market volatility and capitalize on potential opportunities.

In conclusion, staying vigilant and adaptable in response to market dynamics is key to successful investing. By closely monitoring the Nifty index, analyzing key technical and sentiment indicators, and keeping abreast of broader market trends, investors can position themselves strategically in the ever-evolving financial landscape. As we move forward into the week ahead, let us keep a keen eye on the Nifty and its implications for the broader market, ensuring that we are well-prepared to navigate the twists and turns of the financial markets.