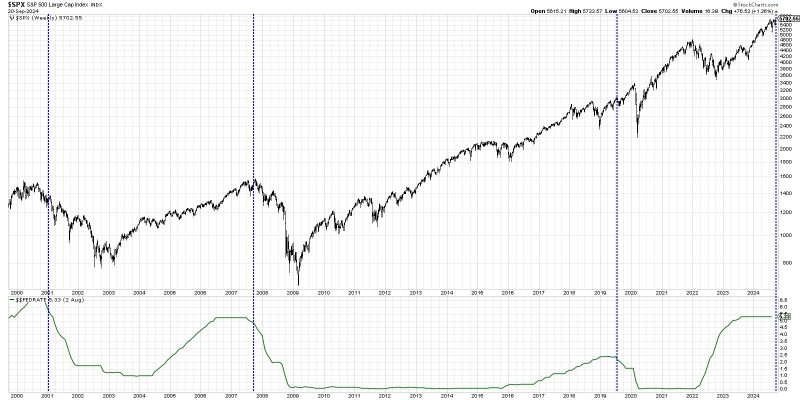

Throughout the history of financial markets, the relationship between interest rate cuts and stock performance has been a topic of debate among investors, economists, and analysts. While some believe that rate cuts have a bullish effect on stock prices, others argue that the impact is more nuanced and can also lead to bearish outcomes. In reality, the truth about rate cuts and stock performance lies in a complex interplay of various factors that influence market dynamics.

One of the key arguments in favor of rate cuts leading to bullish stock performance is the boost they provide to borrowing and spending. When central banks lower interest rates, borrowing becomes cheaper, prompting businesses and consumers to take out loans for investments and purchases. This increased economic activity can drive corporate profits higher, thereby supporting stock prices. Additionally, lower interest rates can make stocks more attractive relative to bonds, leading to a shift in investor preferences towards equities and further boosting stock prices.

However, the bullish impact of rate cuts is not always guaranteed and can be influenced by broader market conditions and expectations. For instance, if rate cuts are implemented in response to concerns about economic weakness or market instability, investors may interpret them as a signal of underlying problems in the economy. In such circumstances, any positive effects of rate cuts on borrowing and spending may be outweighed by pessimism and uncertainty, leading to a bearish sentiment in the stock market.

Moreover, the timing and magnitude of rate cuts can play a crucial role in determining their impact on stock performance. In some cases, preemptive rate cuts designed to stimulate economic growth and mitigate risks can instill confidence in investors and drive stock prices higher. Conversely, rate cuts implemented in response to economic downturns or financial crises may fail to reassure investors or stimulate spending, resulting in limited or even negative effects on stock performance.

Another important consideration when analyzing the relationship between rate cuts and stock performance is the sectoral and individual stock dynamics. While lower interest rates can benefit sectors such as housing, construction, and consumer durables, they may have a negative impact on industries sensitive to interest rate fluctuations, such as banking and finance. Additionally, the performance of individual stocks within a sector can vary based on factors such as company-specific fundamentals, growth prospects, and market positioning, highlighting the need for a nuanced and segmented analysis of the effects of rate cuts on stock prices.

In conclusion, the impact of rate cuts on stock performance is multifaceted and contingent on a wide range of factors that interact to shape market dynamics. While rate cuts can provide a boost to borrowing, spending, and stock prices under certain conditions, their effect may be tempered by broader economic trends, investor sentiment, and sectoral considerations. As such, investors and analysts should exercise caution and conduct thorough research to assess the potential implications of rate cuts on stock performance and adjust their strategies accordingly in response to changing market conditions.