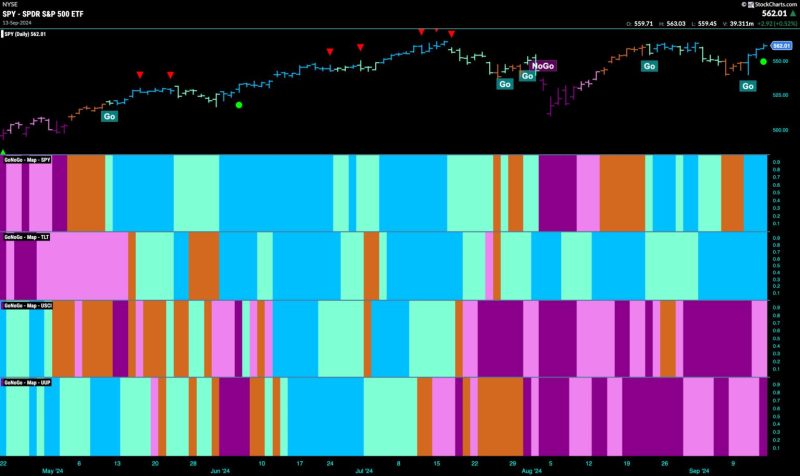

Equity Markets Rebound as Discretionary Out-Performs

The equity markets have recently witnessed a significant rebound, spurred on by a resurgence in the discretionary sector. This uptick in performance has brought relief to investors as they navigate the volatile financial landscape amid global uncertainties.

Discretionary stocks have emerged as the standout performers during this period of market resurgence. Companies in this sector, which include consumer discretionary goods and services, have seen a notable increase in investor interest and stock prices. This renewed confidence in discretionary stocks reflects a growing optimism among investors regarding consumer spending patterns and economic recovery.

The outperformance of discretionary stocks can be attributed to several factors. One key driver is the increasing consumer confidence and spending in the post-pandemic world. As economies gradually reopen and restrictions ease, consumers are more willing to spend on discretionary items such as travel, leisure, and luxury goods. This trend has been bolstered by the rollout of vaccination campaigns and stimulus packages, which have provided a much-needed boost to consumer sentiment.

Additionally, the shift towards remote work arrangements and online shopping has fueled the growth of e-commerce and digital retail platforms. Companies that have successfully capitalized on this trend have seen their stock prices soar, as investors recognize the long-term potential of these businesses in a rapidly changing marketplace.

Another factor contributing to the strong performance of discretionary stocks is the overall bullish sentiment in the equity markets. As major indices reach new highs and investors rotate towards growth-oriented sectors, discretionary stocks have benefited from this broader market optimism. The low interest rate environment and ample liquidity provided by central banks have also played a role in supporting the upward trajectory of equities, including discretionary companies.

Despite the positive momentum in the discretionary sector, investors must remain cautious and vigilant in their decision-making. Market volatility and uncertainties continue to pose challenges, and the risk of sudden reversals in stock prices remains ever-present. Diversification, thorough research, and risk management strategies are essential tools for navigating the dynamic equity markets and mitigating potential losses.

In conclusion, the recent rebound in equity markets, driven by the strong performance of discretionary stocks, highlights the resilience and adaptability of investors in the face of economic uncertainties. The outperformance of companies in the discretionary sector underscores the shifting consumer behavior and evolving market dynamics in a post-pandemic world. By staying informed, proactive, and strategic, investors can position themselves to capitalize on emerging opportunities and weather the inevitable market fluctuations ahead.