Broad-Based Stock Market Selloff: How to Position Your Portfolio

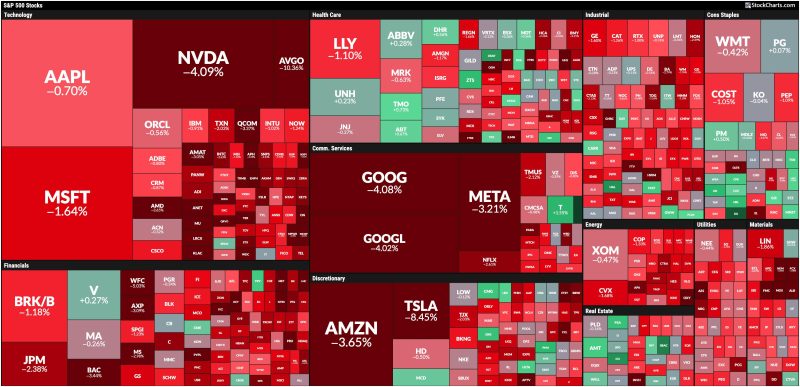

With a broad-based stock market selloff affecting various sectors and industries, investors are pondering how to best position their portfolios to navigate these uncertain times. This volatile market environment has raised concerns among investors about the impact on their investments and the potential strategies they can adopt to weather the storm. In this article, we will delve into some key considerations for positioning a portfolio during a broad-based selloff and explore tactics to help investors safeguard their investments.

1. Review Portfolio Allocation:

The first step in positioning your portfolio during a broad-based selloff is to review your overall asset allocation. Diversification is crucial in minimizing risk during market downturns. Assess the distribution of assets in your portfolio across different sectors, industries, and asset classes. If your investments are heavily concentrated in a particular sector that is being hit hard by the selloff, consider reallocating your assets to spread the risk more evenly.

2. Evaluate Risk Tolerance:

Understanding your risk tolerance is essential when determining how to position your portfolio during a selloff. If you are a conservative investor with a low tolerance for risk, you may want to consider shifting a portion of your investments to safer assets such as bonds or cash equivalents. On the other hand, if you have a higher risk tolerance, you may opt to stay invested in equities but be prepared for potential fluctuations in the market.

3. Focus on Quality:

During a broad-based selloff, investors tend to flock to quality investments that have a track record of resilience in turbulent market conditions. Consider focusing on companies with strong fundamentals, stable earnings, and solid balance sheets. Quality stocks may fare better during market downturns and have the potential to rebound faster when the market recovers.

4. Keep an Eye on Valuations:

Valuation metrics play a crucial role in determining the attractiveness of stocks during a selloff. Look for opportunities in undervalued companies that have strong growth prospects but are trading at a discount due to market sentiment. Conduct thorough research and analysis to identify stocks that have the potential for long-term growth despite the current market conditions.

5. Stay Informed and Remain Calm:

During a broad-based selloff, it is important to stay informed about market developments and economic indicators. Keep a close eye on news that could impact the market and be prepared to make informed decisions based on sound analysis rather than emotions. Remember to remain calm and avoid making impulsive investment decisions that could lead to unnecessary losses.

In conclusion, navigating a broad-based stock market selloff requires a strategic approach and careful consideration of various factors affecting the market. By reviewing your portfolio allocation, evaluating your risk tolerance, focusing on quality investments, monitoring valuations, and staying informed, you can position your portfolio to withstand market volatility and capitalize on opportunities that arise during challenging times. Remember that market downturns are a natural part of investing, and staying disciplined and patient can ultimately lead to long-term investment success.