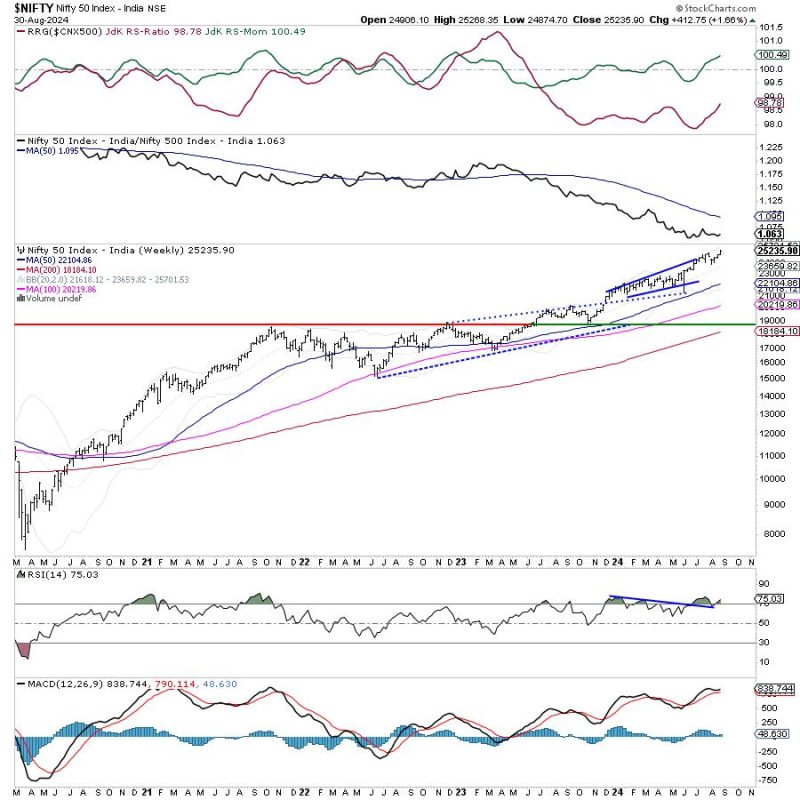

The week ahead promises to be an interesting one for traders and investors as the uptrend remains intact for the Nifty index. Despite recent market fluctuations, the Relative Rotation Graph (RRG) analysis reveals a distinctly defensive setup.

Looking at the technical indicators, the Nifty index has managed to stay above its key support levels, suggesting continued bullish sentiment among market participants. The RRG analysis, however, paints a different picture as it shows a shift towards defensive sectors, indicating a potential rotation away from riskier assets.

One sector that stands out on the RRG is the IT sector, which has been displaying relative strength compared to other sectors. This could be attributed to the increased demand for tech services and products in the current global environment. Additionally, the pharmaceutical sector is also showing signs of relative strength, possibly due to the ongoing focus on healthcare and medical research.

On the defensive end, sectors like utilities and consumer staples are moving towards the leading quadrant on the RRG chart. This shift towards defensive sectors may indicate a sense of caution among investors, possibly in response to global uncertainties and market volatility.

It is essential for traders and investors to keep a close watch on the market dynamics in the coming week. While the uptrend for the Nifty index remains intact, the defensive setup on the RRG suggests a need for a cautious approach. Monitoring key support and resistance levels, as well as sectoral rotations, can provide valuable insights for making informed trading decisions.

Overall, the market outlook for the week ahead is a mix of optimism and caution. By staying informed and adapting to changing market conditions, traders and investors can navigate the uncertainties and capitalize on potential opportunities that may arise.