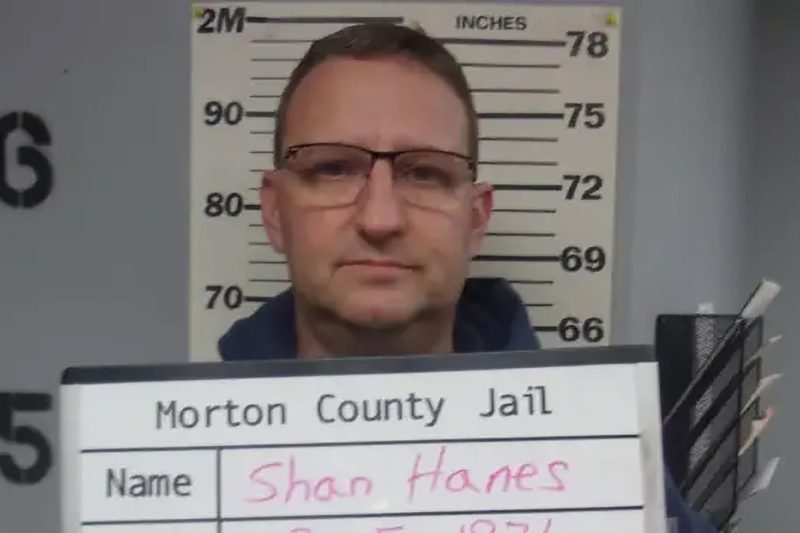

Cryptocurrency Pig Butchering Scam Wrecks Kansas Bank, Sends Ex-CEO to Prison for 24 Years

The recent case of a cryptocurrency pig butchering scam that wrecked a Kansas bank and led to the imprisonment of the ex-CEO for 24 years serves as a stark reminder of the risks associated with emerging financial technologies. This scandal, which unfolded in a small town in Kansas, has sent shockwaves through the financial industry and raised concerns about the security and regulation of digital assets.

The scheme, masterminded by the bank’s former CEO, involved the use of cryptocurrency to lure investors into a fraudulent investment opportunity that promised high returns. As part of the scam, unsuspecting investors were persuaded to purchase shares in a pig butchering operation that purportedly leveraged cutting-edge blockchain technology to enhance efficiency and profitability.

However, investigations revealed that the entire operation was a sham, with the CEO diverting funds for personal use and fabricating financial reports to deceive stakeholders. The collapse of the scheme led to significant financial losses for investors, many of whom were left devastated and struggling to recover their investments.

The fallout from the scandal was not limited to financial losses; it also had far-reaching consequences for the Kansas bank, which was forced into receivership due to the mismanagement and fraud perpetrated by its former CEO. The scandal tarnished the institution’s reputation and eroded public trust in traditional financial institutions.

Furthermore, the case highlighted the challenges facing regulators in overseeing the rapidly evolving cryptocurrency landscape. The decentralized nature of cryptocurrencies, combined with the lack of clear regulatory frameworks, creates opportunities for fraudulent actors to exploit unsuspecting investors. In this instance, the ex-CEO’s manipulation of digital assets showcased the vulnerabilities inherent in the current regulatory environment.

As a result of the investigation, the ex-CEO was sentenced to 24 years in prison for his role in orchestrating the cryptocurrency pig butchering scam. The severity of the sentence underscores the gravity of financial crimes involving cryptocurrencies and sends a stern warning to others who may consider engaging in similar illicit activities.

In conclusion, the cryptocurrency pig butchering scam that wreaked havoc on a Kansas bank serves as a cautionary tale for investors and regulators alike. As the digital asset landscape continues to evolve, it is essential for stakeholders to remain vigilant and take proactive measures to safeguard against fraudulent schemes. By learning from this case and implementing robust regulatory mechanisms, we can protect the integrity of financial markets and prevent future incidents of this nature.