The article discusses three market sentiment indicators that confirm a bearish phase. Market sentiment indicators play a crucial role in assessing the overall mood and psychology of investors in the financial markets. These indicators provide insights into whether traders are feeling bullish or bearish about the direction of the market.

The first market sentiment indicator discussed in the article is the Put/Call Ratio. This ratio measures the volume of puts to calls traded on the market. A high Put/Call Ratio indicates that investors are buying more puts (bearish bets) relative to calls (bullish bets), suggesting a prevailing sense of negativity and fear among investors. Conversely, a low Put/Call Ratio may signal excessive optimism and complacency in the market.

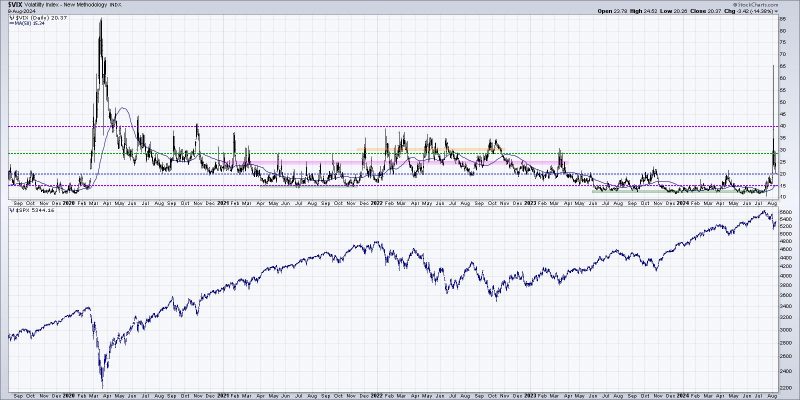

The second indicator highlighted is the VIX Volatility Index, also known as the fear gauge. The VIX measures expected market volatility based on S&P 500 options prices. When the VIX is high, it indicates that investors are anticipating increased volatility and uncertainty in the market. This heightened fear can lead to selling pressure and downward price movements in the stock market.

The third indicator discussed in the article is the Investor Sentiment Survey. This survey collects data on investor sentiment and market outlook from individual investors and financial professionals. A bearish sentiment in this survey can indicate a lack of confidence in the market’s future prospects, potentially leading to a downward trend in stock prices.

By analyzing these three market sentiment indicators together, investors can gain a comprehensive understanding of the prevailing mood in the market. A convergence of bearish signals from these indicators may suggest an increased likelihood of a bearish phase in the market, prompting investors to exercise caution and potentially adjust their investment strategies accordingly.

In conclusion, market sentiment indicators are valuable tools for investors to gauge market sentiment and anticipate potential market movements. By closely monitoring indicators such as the Put/Call Ratio, VIX Volatility Index, and Investor Sentiment Survey, investors can make informed decisions and navigate potential bearish phases in the market effectively.