Bullish Gap-Down Reversals: A Trader’s Guide to Profit Maximization

Bullish gap-down reversals represent a unique trading opportunity in the financial markets. When a stock experiences a significant price gap downward at the market open but then reverses course to close higher on the same day, traders can potentially capitalize on the ensuing shift in market sentiment. This article delves into the key principles and strategies that traders can employ to profit from bullish gap-down reversals effectively.

Understanding the Dynamics of Bullish Gap-Down Reversals

Bullish gap-down reversals occur when a stock or market experiences a gap-down at the opening bell, signaling a bearish sentiment among investors. However, as the trading day progresses, the price reverses direction and closes higher, often erasing most or all of the initial losses. This reversal indicates a shift in market sentiment from bearish to bullish, presenting an attractive opportunity for traders.

Key Components of Bullish Gap-Down Reversals

To effectively capitalize on bullish gap-down reversals, traders should pay attention to several key components:

1. Volume: An increase in trading volume during the reversal signals strong buying interest and confirms the bullish sentiment. High volume validates the reversal and provides additional confirmation for traders.

2. Support and Resistance Levels: Identifying key support and resistance levels can help traders gauge the strength of the reversal. Bouncing off a significant support level or breaking through a resistance level with conviction can signal a robust bullish reversal.

3. Price Patterns: Traders should look for bullish price patterns, such as engulfing patterns or hammer candles, that indicate a potential reversal. These patterns provide valuable insights into market sentiment and can help traders time their entries and exits.

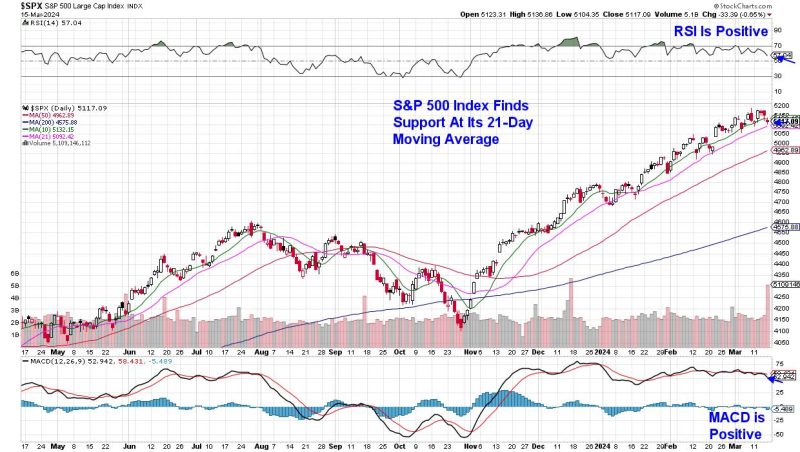

4. Confirmation Indicators: Utilizing technical indicators such as moving averages, MACD, or RSI can provide additional confirmation of the bullish reversal. Convergence of multiple indicators can strengthen the likelihood of a successful trade.

Strategies for Profiting from Bullish Gap-Down Reversals

1. Gap Fading: One common strategy is to fade the initial price gap by going long on the stock as it reverses higher. Traders can enter a trade as the price retraces back toward the opening price, aiming to profit from the price recovery.

2. Breakout Trading: Traders can also wait for the stock to break through key resistance levels following the reversal. Breakout trading involves entering a position as the price moves above a significant resistance level, anticipating further upside momentum.

3. Trend Following: Following the trend post-reversal can be a profitable strategy for traders. By identifying the emerging bullish trend and riding the momentum, traders can maximize their profits as the price continues to climb.

In conclusion, bullish gap-down reversals offer lucrative trading opportunities for savvy traders who can accurately identify and capitalize on these market dynamics. By understanding the key components of bullish gap-down reversals and implementing effective trading strategies, traders can profit from these reversals while managing risk effectively. Mastering the art of trading bullish gap-down reversals can lead to consistent profits and enhanced trading performance in the financial markets.