The Hindenburg Omen: Decoding the Initial Sell Signal

The Hindenburg Omen has long been a topic of interest among investors and traders alike. Originating in the 1970s, this technical indicator is designed to predict potential stock market crashes by identifying market breadth divergences characterized by an unusually high number of new highs and new lows on the New York Stock Exchange.

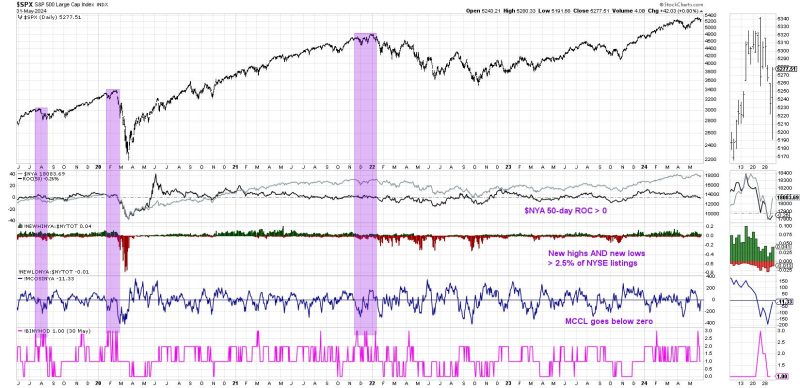

This sophisticated indicator takes into account several key factors to generate a signal, including the number of advancing and declining issues, the 10-week moving average of the NYSE composite index, and the McClellan Oscillator. When these components align in a specific way, it triggers the Hindenburg Omen signal.

When the Hindenburg Omen flashes an initial sell signal, as observed recently, it can serve as a cautionary flag for investors. This signal suggests that market internals are weakening, and there may be underlying stress in the market that could lead to a significant pullback or correction in stock prices.

While the Hindenburg Omen has gained attention for its ability to potentially signal market downturns, it is essential for investors to approach it with caution. Like any technical indicator, the Hindenburg Omen is not foolproof and can produce false signals. It is crucial to consider other factors and indicators in conjunction with the Hindenburg Omen to make well-informed investment decisions.

Investors should not rely solely on the Hindenburg Omen or any single indicator to guide their investment strategy. Instead, a comprehensive approach that incorporates fundamental analysis, technical analysis, and risk management is key to navigating the complexities of the stock market.

In conclusion, the Hindenburg Omen’s initial sell signal can provide valuable insights into the market’s breadth and potential vulnerabilities. However, investors should exercise prudence and diligence in interpreting and acting upon this signal, considering it within the broader context of market dynamics. By staying informed, remaining analytical, and diversifying their investment portfolios, investors can better position themselves to weather market volatility and achieve their financial goals.