In recent weeks, market watchers have observed a concerning trend that suggests the market may be reaching a possible top. This observation has given rise to discussions and speculations among investors and analysts alike. A culmination of various factors has led to this sentiment, including but not limited to:

1. **Overvaluation Concerns**: One of the primary reasons contributing to the view that the market is looking toppy is the persistently high valuations across various sectors and asset classes. Valuation metrics such as price-to-earnings ratios and price-to-sales ratios are significantly above historical averages, indicating frothiness in the market.

2. **Rising Interest Rates**: The anticipation of rising interest rates has been a key factor in the recent unease among investors. The Federal Reserve’s signaling of a potential shift towards a tighter monetary policy has led to fears of increased borrowing costs, which could impact corporate profitability and consumer spending.

3. **Inflationary Pressures**: Another factor influencing the view of a toppy market is the growing concerns over inflation. The escalating prices of goods and services, coupled with supply chain disruptions, have raised fears of sustained inflationary pressures that could erode purchasing power and margins.

4. **Geopolitical Uncertainties**: Geopolitical tensions and uncertainties, such as the Russia-Ukraine conflict and ongoing trade disputes, add another layer of complexity to the current market environment. These external factors can introduce volatility and unpredictability, creating a risk-off sentiment among investors.

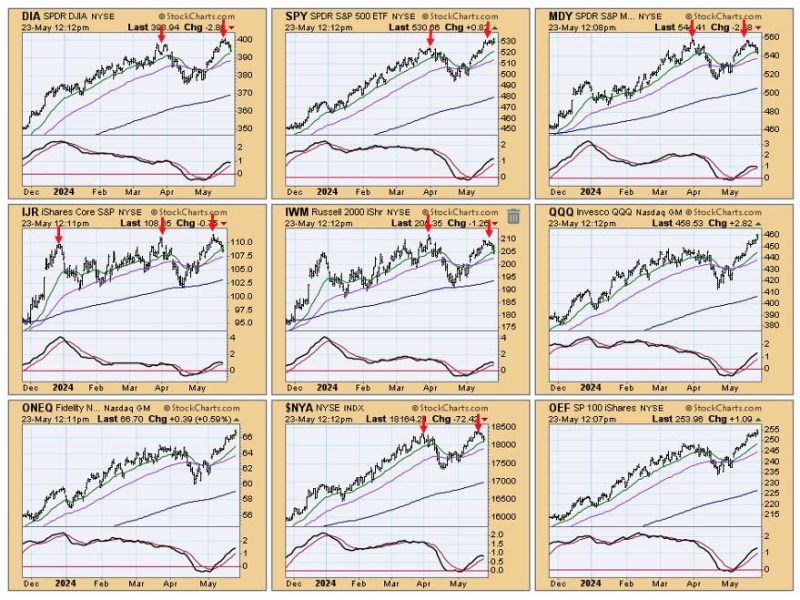

5. **Market Sentiment and Technical Indicators**: Market sentiment plays a crucial role in determining the direction of asset prices. When sentiment turns cautious or pessimistic, it can lead to a shift in market dynamics. Additionally, technical indicators, such as moving averages and relative strength indexes, are signaling potential overbought conditions in certain sectors or indices.

6. **Sector Rotation and Divergence**: Observing the market through a sectoral lens reveals interesting dynamics. While some sectors have seen significant appreciation and investor interest, others have lagged behind. This sectoral rotation and divergence could indicate a lack of broad-based momentum, potentially signaling an approaching market top.

Considering these factors, investors are advised to remain vigilant and exercise caution in their investment decisions. Diversification, risk management, and a long-term perspective are essential strategies to navigate through uncertain market conditions. While timing the market is notoriously difficult, staying informed, staying disciplined, and staying prepared for various scenarios can help investors weather potential market downturns and capitalize on opportunities that may arise.

In conclusion, the market’s current state has prompted discussions around the possibility of a looming top. By understanding the drivers behind this sentiment and adopting prudent investment strategies, investors can better position themselves to navigate through volatile market phases and make informed decisions suited to their financial goals and risk tolerance. Vigilance and adaptability will be key in navigating the uncertainties that lie ahead.