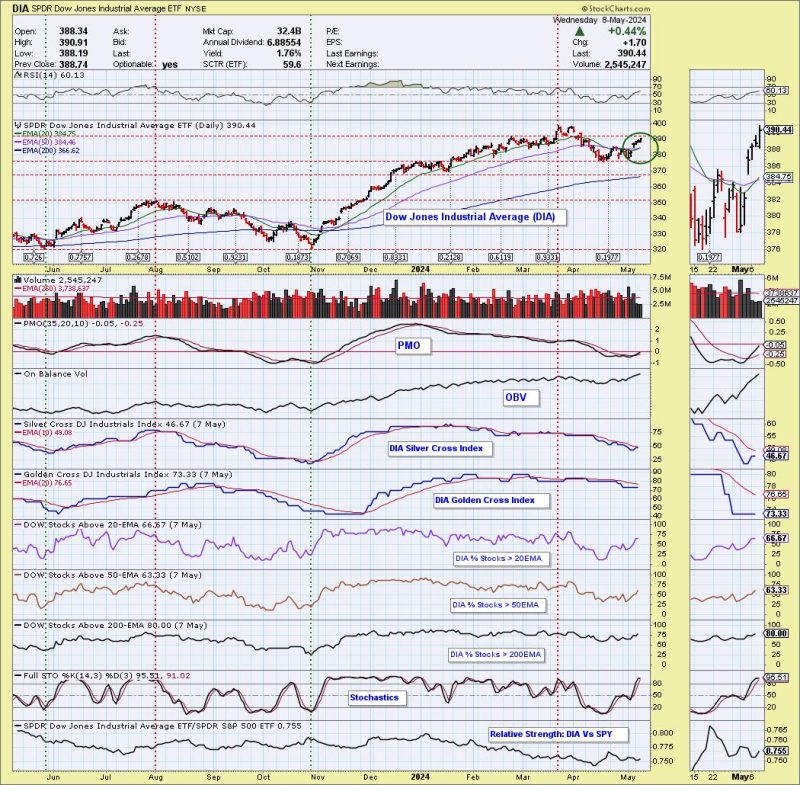

In a recent analysis by Godzilla Newz, the stock market has shown silver cross buy signals on prominent indices such as the Dow Jones Industrial Average (DIA) and the Russell 2000 (IWM). This indicator, known for its significance in technical analysis, is a bullish signal that may indicate a potential upward trend in the market.

The Dow Jones Industrial Average, a key benchmark index that tracks 30 large and well-known companies, has flashed a silver cross buy signal. This signal occurs when the short-term moving average crosses above the long-term moving average, typically the 50-day moving average crossing over the 200-day moving average. This crossover is considered a bullish indicator by many market analysts.

Similarly, the Russell 2000 index, which tracks small-cap stocks, has also shown a silver cross buy signal. Small-cap stocks are often seen as a barometer of economic health, as they are more closely tied to domestic economic activity. The silver cross buy signal on the Russell 2000 may suggest that investors are confident in the prospects of small-cap companies and the overall economy.

It is worth noting that while silver cross buy signals are considered bullish indicators, they are not foolproof and should be taken into consideration along with other factors before making investment decisions. Market conditions can change rapidly, and it is important for investors to conduct thorough research and risk analysis before committing capital to any investment opportunity.

In conclusion, the occurrence of silver cross buy signals on the Dow Jones Industrial Average and the Russell 2000 index may hint at a potential uptrend in the stock market. Investors should remain vigilant and monitor market developments closely to make informed decisions regarding their investment portfolios.