The Relative Rotation Graph (RRG) has become a popular tool for traders and investors to analyze the performance of various assets or sectors against a benchmark. By visualizing the relative strength and momentum of different securities, RRGs can unveil potential trading opportunities and guide decision-making processes.

In the article Diverging Tails on This Relative Rotation Graph Unveil Trading Opportunities, the author explores how RRGs can be used to identify assets that are outperforming or underperforming their peers. This approach relies on the concept of rotation, where assets move from one quadrant of the RRG to another, indicating changes in their relative strength and momentum.

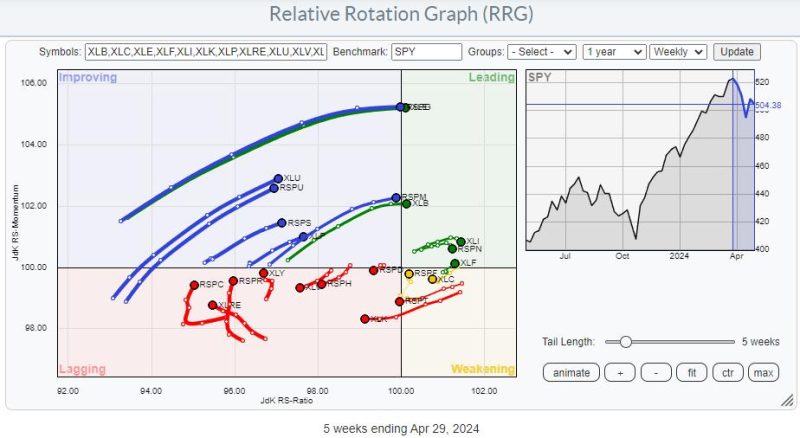

The RRG displayed in the article highlights the diverging tails of two assets, symbolized by points on the graph moving in opposite directions. This contrast suggests significant differences in the performance of the two assets compared to their peers. By focusing on these diverging tails, traders can pinpoint potential trading opportunities that align with their investment goals.

One key aspect of using RRGs for trading is understanding the implications of asset rotation. Assets that move from the weakening quadrant towards the leading quadrant are considered strong performers with improving momentum, signaling the potential for further price appreciation. Conversely, assets moving from the leading quadrant to the lagging quadrant may be losing strength and could be candidates for selling or shorting.

Furthermore, the author emphasizes the importance of combining RRG analysis with other technical indicators and fundamental research to validate trading decisions. While RRGs provide valuable insights into relative performance, they should be used in conjunction with other tools to confirm signals and manage risk effectively.

In conclusion, RRGs offer a dynamic and visual way to assess the relative strength and momentum of assets, uncovering trading opportunities in the market. By observing diverging tails on the RRG, traders can identify assets that are poised for either outperformance or underperformance compared to their peers. Integrating RRG analysis with a comprehensive trading strategy can enhance decision-making processes and potentially lead to more profitable trades in today’s dynamic financial markets.