As we delve into the current economic landscape, one cannot ignore the potential opportunities brewing within the forex market. The intricate world of foreign exchange is ever-evolving and contains a multitude of factors that shape global economies and influence currency values. One currency that has been closely scrutinized in recent times is the United States Dollar (USD), with many speculating on whether it is setting up for a significant rally.

A crucial element to consider when predicting the trajectory of the USD is the state of the US economy. The performance of the US economy has a direct impact on the value of the dollar. Factors such as GDP growth, employment rates, inflation, and monetary policy all play a part in determining the strength of the dollar in the forex market. A robust and growing economy typically results in a stronger currency, as investors are more confident in its stability and potential for returns.

In recent months, the US economy has shown signs of recovery and resilience, following the tumultuous events of the past year. With vaccine rollouts and stimulus packages injecting much-needed growth into various sectors, there is growing optimism surrounding the US economic outlook. This positive momentum could translate into a stronger USD, as investors flock to the currency in search of stability and higher returns.

Furthermore, the Federal Reserve’s monetary policy decisions are crucial in shaping the value of the USD. Interest rate hikes or cuts, quantitative easing measures, and forward guidance all have implications for the dollar’s strength in the forex market. As the world’s reserve currency, the USD is closely watched by investors globally, making Federal Reserve actions a key driver of USD performance.

Geopolitical events also play a significant role in shaping currency values, including the USD. Tensions between nations, trade agreements, and global events can all impact investor sentiment and currency flows. As a safe-haven currency, the USD tends to strengthen in times of uncertainty or volatility, as investors seek shelter from riskier assets.

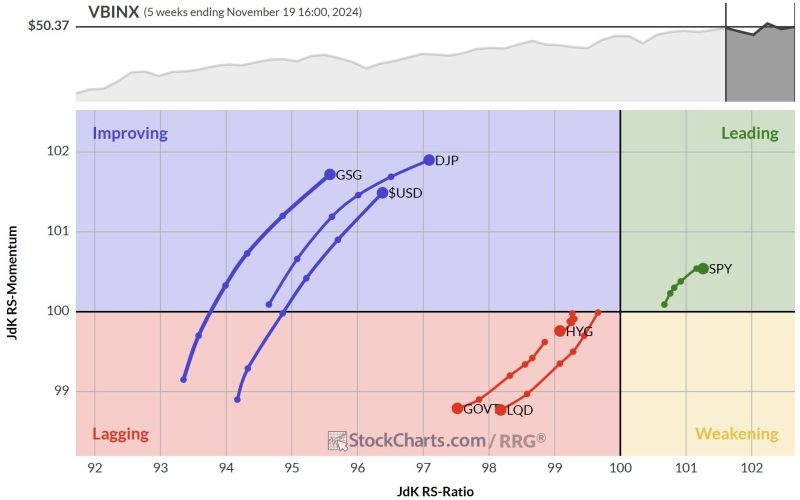

Technical analysis is another tool utilized by forex traders to gauge potential currency movements. Chart patterns, support and resistance levels, and other indicators can provide valuable insights into market sentiment and potential price movements. By combining fundamental analysis with technical analysis, traders can develop a more comprehensive view of the market and make informed trading decisions.

In conclusion, while predicting currency movements is a complex and challenging task, the USD’s potential for a rally is a topic of much discussion among forex traders and analysts. The interplay of economic, geopolitical, and technical factors all contribute to shaping the value of the USD in the forex market. As the US economy continues its recovery and the Federal Reserve navigates its monetary policy decisions, the USD’s performance remains a focal point for investors seeking opportunities in the forex market.