In the world of investing, exchange-traded funds (ETFs) have become increasingly popular due to their ease of access and diversification benefits. When it comes to the semiconductor industry, two prominent ETFs, SMH and SOXX, are often compared for their performance and holdings. Despite both ETFs focusing on semiconductor stocks, a closer look reveals that SMH is holding up better than SOXX in recent times.

One key reason for SMH outperforming SOXX is its well-balanced portfolio. SMH, which tracks the MVIS US Listed Semiconductor 25 Index, holds a diversified mix of large-cap, mid-cap, and small-cap semiconductor companies. This diversification helps reduce risk and provides exposure to different segments of the semiconductor industry.

On the other hand, SOXX, which tracks the PHLX SOX Semiconductor Sector Index, is more concentrated in large-cap semiconductor stocks. While this concentration can lead to higher returns during bullish market conditions, it also exposes investors to higher volatility and downside risk when the market turns bearish.

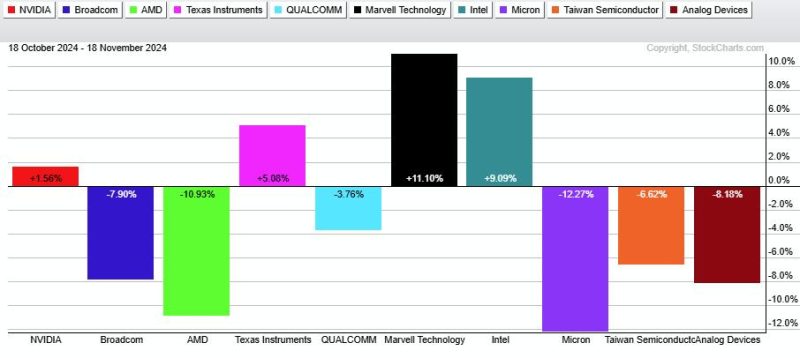

Additionally, the top holdings of SMH and SOXX differ, contributing to their performance disparity. SMH’s top holdings include industry giants like NVIDIA, Intel, and Taiwan Semiconductor Manufacturing Company (TSMC). These companies have shown resilience and strong growth potential, helping SMH weather market fluctuations.

In contrast, SOXX’s top holdings are dominated by a few companies, with NVIDIA and Intel making up a significant portion of the ETF. Overreliance on a few stocks can amplify the impact of negative news or performance from those companies, leading to downward pressure on the ETF as a whole.

Furthermore, the market dynamics and global demand for semiconductors play a crucial role in distinguishing the performance of SMH and SOXX. With the increasing adoption of technologies like artificial intelligence, 5G, and Internet of Things (IoT), semiconductor companies are benefiting from growing demand for their products.

SMH’s diversified portfolio and exposure to various subsectors within the semiconductor industry allow it to benefit from this growing demand. In comparison, SOXX’s concentration in a few large-cap stocks may limit its ability to capture the full potential of emerging trends in the semiconductor market.

In conclusion, while both SMH and SOXX provide investors with exposure to the semiconductor industry, their differences in portfolio composition, top holdings, and market dynamics contribute to their diverging performance. SMH’s diversified portfolio and balanced mix of companies have helped it hold up better than SOXX in recent times. As investors navigate the semiconductor ETF space, understanding these nuances can guide their investment decisions and help them capitalize on the opportunities presented by this dynamic sector.