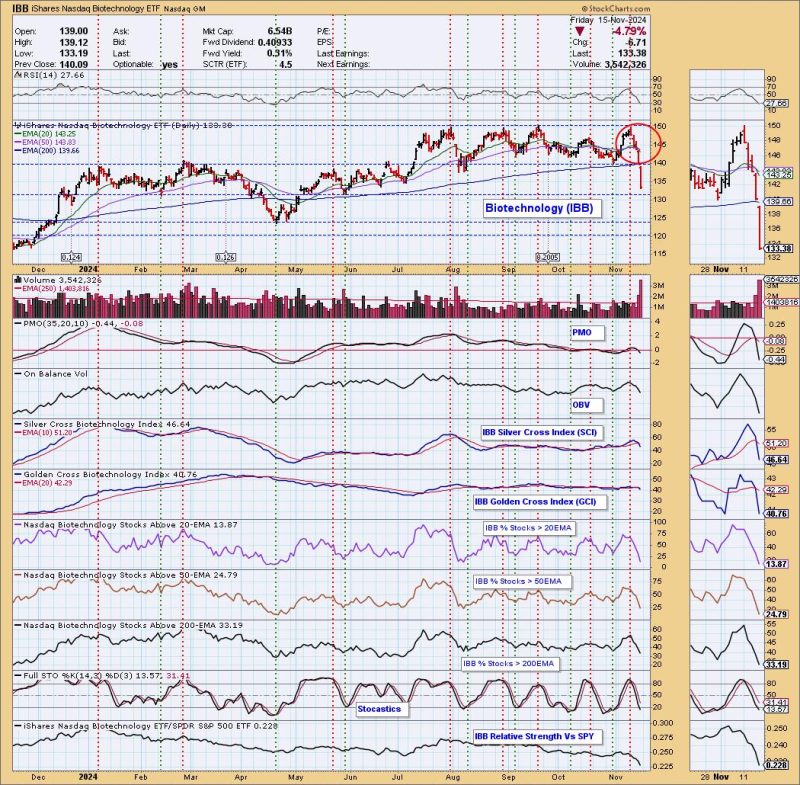

Biotech companies play a crucial role in advancing healthcare and driving innovation in the medical field. However, recent developments have raised concerns among investors and industry analysts as biotechs face challenges and uncertainties that could impact their performance and growth potential. The emergence of a dark cross neutral signal in the biotech sector is a key indicator of potential troubles ahead.

The term dark cross neutral signal refers to a technical analysis pattern commonly used in the stock market to identify potential shifts in market sentiment. In the context of biotechs, this signal suggests a convergence of negative factors that could lead to a downturn in stock prices and company valuations.

One of the primary factors contributing to the dark cross signal in biotechs is regulatory uncertainty. The biotech industry is heavily regulated, with companies needing to navigate complex approval processes and comply with stringent safety and efficacy standards. Any delays or setbacks in the regulatory approval of a company’s products can have a significant impact on its financial performance and investor confidence.

Furthermore, biotechs are highly dependent on funding for research and development. Many biotech companies rely on external sources of capital, such as venture capital firms and institutional investors, to finance their operations. A lack of funding or a decrease in investor interest can constrain a company’s ability to advance its pipeline and bring new products to market.

In addition, market volatility and macroeconomic factors can also influence the performance of biotech stocks. The biotech sector is particularly sensitive to shifts in investor sentiment, global economic conditions, and geopolitical events. Uncertainty surrounding trade policies, interest rates, and healthcare regulations can create headwinds for biotech companies, making it challenging for them to maintain sustainable growth.

The dark cross signal serves as a reminder for investors to exercise caution and conduct thorough due diligence when evaluating biotech stocks. While the biotech sector offers significant potential for growth and innovation, it also carries inherent risks and uncertainties that can impact investment outcomes. Investors should closely monitor regulatory developments, funding trends, and market conditions to make informed decisions about their biotech investments.

In conclusion, the emergence of a dark cross neutral signal in the biotech sector underscores the challenges and uncertainties facing biotech companies. Regulatory hurdles, funding constraints, and market volatility are key factors contributing to this signal, highlighting the need for investors to approach biotech investments with caution and vigilance. By staying informed and conducting thorough research, investors can navigate the complexities of the biotech industry and make sound investment decisions.