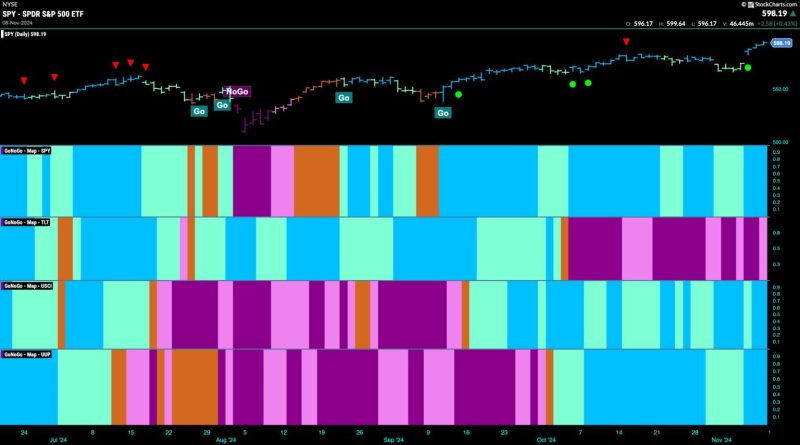

Equity Go Trend Sees Surge in Strength as Financials Drive Price Higher

The equity market has been witnessing a significant surge in strength lately, with particular emphasis on the financial sector driving prices higher. This trend, commonly known as the Equity Go Trend, has caught the attention of investors and analysts alike, prompting a closer examination of the underlying factors at play.

At the heart of this upward momentum is the robust performance of financial institutions, with banks and other financial services companies leading the charge. These entities have reported strong earnings, increased revenues, and healthy balance sheets, all of which have contributed to their attractiveness in the eyes of investors.

One of the key drivers behind the increased interest in financial stocks is the expectation of rising interest rates. As central banks around the world signal a shift towards tighter monetary policy, financial institutions stand to benefit from wider interest rate spreads, which can boost their profitability.

Moreover, the overall economic environment has been supportive of financial stocks, with GDP growth, low unemployment rates, and a favorable regulatory landscape creating a conducive backdrop for these companies to thrive. As a result, investors have shown a growing appetite for financial equities, driving their prices higher in the process.

Another factor fueling the Equity Go Trend is the ongoing wave of mergers and acquisitions in the financial sector. Consolidation activity has been on the rise, with large financial institutions seeking to expand their market share and diversify their revenue streams through strategic acquisitions. This flurry of deal-making has generated excitement among investors, as it signals confidence in the long-term prospects of the sector.

Furthermore, technological advancements and digital transformation initiatives have played a pivotal role in supporting the growth of financial stocks. Fintech innovations have enabled financial institutions to enhance their service offerings, improve operational efficiency, and reach a broader customer base, thereby driving shareholder value and boosting stock prices.

It is important to note that while the Equity Go Trend has been largely fueled by the financial sector, other industries have also contributed to the overall market strength. Sectors such as technology, healthcare, and consumer discretionary have also seen notable gains, underscoring the broad-based nature of the current bullish sentiment in the equity market.

In conclusion, the Equity Go Trend has emerged as a dominant theme in the equity market, propelled by the strength of financial stocks and supported by positive economic fundamentals, rising interest rates, merger activity, and technological advancements. While the momentum may ebb and flow in the short term, the underlying drivers suggest that the current trend could persist in the foreseeable future, making it essential for investors to stay attuned to these developments and adjust their investment strategies accordingly.