In a constantly evolving market landscape, where cycles of prosperity and adversity frequently shape investor sentiments, the current trend towards a secular bull market continues to garner attention and speculation. However, the nuance lies in the major rotation that is steering the trajectory of this enduring uptrend.

One of the pivotal shifts discernible in the market is the transition from growth-oriented stocks to value stocks. Traditionally, growth stocks have been the darlings of investors, enthralling them with promises of exponential expansion and substantial returns. Yet, as the market dynamics adapt to changing economic conditions and inflationary pressures, the pendulum has swung towards value stocks. These undervalued stocks possess robust fundamentals and are perceived as potential outperformers in the prevailing market environment.

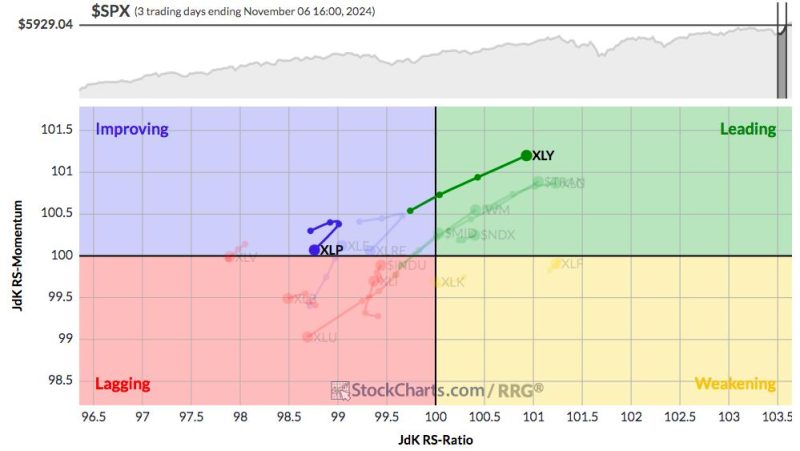

The technology sector, which had been the cornerstone of growth investing, is experiencing a notable deceleration in performance. The surging interest rates are impeding the growth trajectory of tech companies, prompting investors to reallocate their capital towards other avenues such as energy, financials, and industrials. As a result, sectors that were once overshadowed are now seizing the spotlight, indicative of the cyclicality inherent in market trends.

Furthermore, geopolitical tensions and macroeconomic indicators are playing a decisive role in sculpting the contours of the secular bull market. The U.S.-China trade war, political instabilities, and global supply chain disruptions are contributory factors that add an element of uncertainty to the investing landscape. Nonetheless, prudent investors are navigating these headwinds by diversifying their portfolios and adopting a strategic approach that aligns with the prevailing market sentiment.

Within this intricate tapestry of market dynamics, the key to successful investing lies in adaptability and foresight. Embracing the ethos of contrarianism, wherein opportunities are sought in undervalued assets that possess intrinsic strength, can be a viable strategy in the current environment. As the market continues to evolve, astute investors are positioning themselves to capitalize on emerging trends and capitalize on the shifting paradigms of the secular bull market.

In conclusion, the continuum of the secular bull market is emblematic of resilience and adaptability in the face of ever-changing market forces. The major rotation underway signifies a metamorphosis in investor preferences and sectoral dynamics, necessitating a recalibration of investment strategies. By remaining attuned to the prevailing trends, leveraging diversification, and embracing a nuanced approach to investing, market participants can navigate the complexities of the secular bull market and potentially unlock untapped opportunities amidst the prevailing uncertainties.