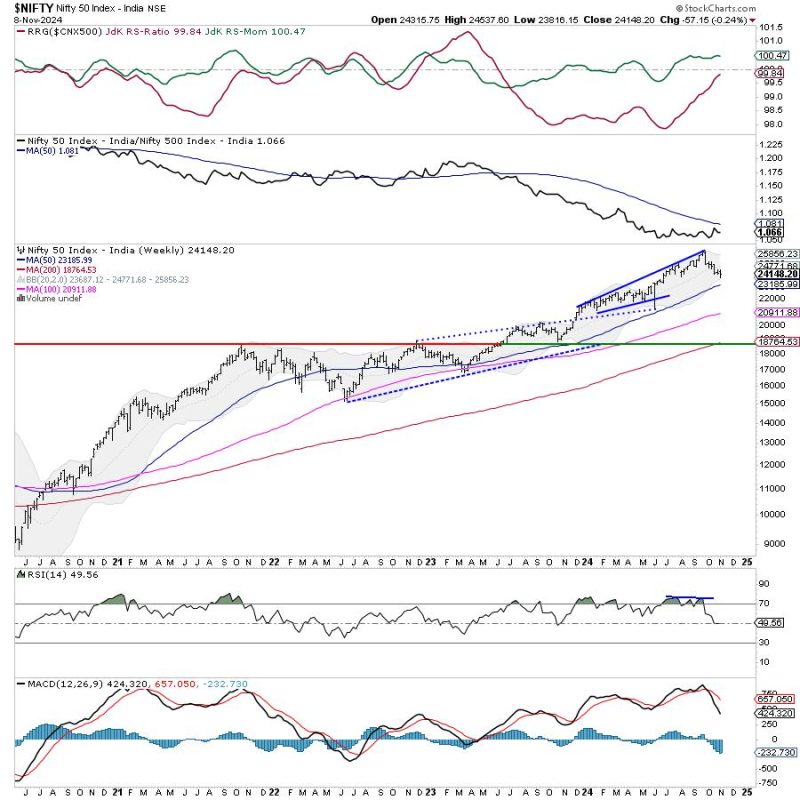

The upcoming trading week for the Nifty index appears to hold uncertain prospects, with various resistances looming over its progress. Technical analysis indicates that the Nifty index might face resistance at multiple levels, presenting challenges for bullish momentum. Traders and investors should remain cautious and vigilant to navigate the market dynamics effectively.

One of the primary reasons for the expected sluggishness in the Nifty index is the presence of key resistance levels within its current trading zone. These resistances act as barriers that may impede the upward movement of the index, leading to a state of consolidation or potential retracement. Traders should closely monitor these levels to assess the likelihood of a breakout or a reversal.

Furthermore, market sentiment and external factors such as global economic trends and geopolitical events can significantly influence the Nifty index’s performance. Uncertainties surrounding trade tensions, monetary policy decisions, and corporate earnings releases can introduce volatility and impact market sentiment. It is essential for traders to stay informed about these developments and adapt their strategies accordingly.

Technical indicators can serve as valuable tools for traders to identify potential entry and exit points in the market. Moving averages, Fibonacci retracements, and chart patterns can offer insights into the Nifty index’s price movements and help traders make informed decisions. By combining technical analysis with a sound risk management strategy, traders can enhance their chances of success in navigating the market volatility.

Moreover, keeping an eye on sectoral performance and industry-specific news can provide valuable insights into the broader market dynamics. Certain sectors may outperform or underperform during a particular period, creating opportunities for traders to capitalize on emerging trends. By maintaining a diversified portfolio and staying abreast of sectoral developments, traders can position themselves strategically in the market.

In conclusion, the week ahead presents a challenging environment for the Nifty index, characterized by multiple resistances and external uncertainties. Traders should exercise caution, conduct thorough analysis, and adapt their strategies to navigate the market effectively. By leveraging technical indicators, monitoring market sentiment, and staying informed about sectoral dynamics, traders can position themselves for success in the ever-evolving stock market landscape.