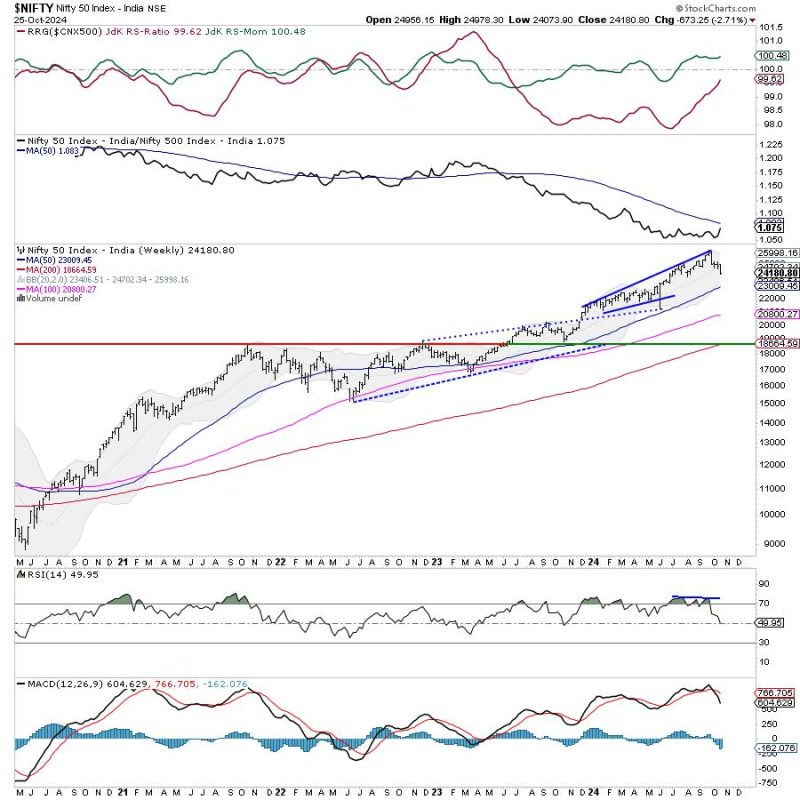

The financial markets have been witnessing significant movements, with the Nifty index breaking key support levels and facing resistance at lower levels. The evolving market dynamics have implications for traders and investors alike, necessitating a closer look at the current scenario.

Support Breakdown:

The recent breach of key support levels by the Nifty index has reverberated across the financial landscape. This breakdown indicates a shift in market sentiment and prompts a reevaluation of the prevailing trends. Traders are closely monitoring the evolving situation to gauge the potential implications on their positions and portfolios.

Resilience and Adaptation:

In the face of market challenges, resilience and adaptability are crucial virtues for traders and investors. The ability to swiftly adapt to changing market conditions and make informed decisions is paramount for navigating turbulent times. Those who can adjust their strategies in response to shifting trends may find opportunities amid the volatility.

Technical Analysis and Trend Forecasting:

Technical analysis serves as a valuable tool for market participants seeking to understand price movements and forecast potential trends. By analyzing historical price data and market indicators, traders can gain insights into possible future directions. However, the dynamic nature of markets highlights the importance of continuous monitoring and adjustment of strategies based on new information.

Risk Management and Position Sizing:

Effective risk management is essential for safeguarding capital in volatile market conditions. Traders must implement robust risk management strategies, including stop-loss orders, position sizing, and diversification, to mitigate potential losses. By controlling risk exposure and maintaining discipline, traders can weather market fluctuations and enhance their long-term success.

Opportunities Amidst Challenges:

While market challenges abound, opportunities also emerge for those who can identify them. Volatile market conditions often create openings for profitable trades and investments, provided traders remain vigilant and adaptive. By staying informed, leveraging market insights, and exercising discipline, traders can capitalize on opportunities that arise amidst turbulent market environments.

Looking Ahead:

As we navigate the changing dynamics of the financial markets, vigilance and adaptability are key principles for traders and investors. The recent developments in the Nifty index serve as a reminder of the ever-evolving nature of markets and the need for continuous assessment and adjustment of strategies. By staying informed, disciplined, and proactive, market participants can position themselves for success in the face of uncertainty.