The article you provided touches upon the potential trends and movements in the Nifty market. Keeping this in mind, the following article delves deeper into the intricacies of technical analysis and market predictions.

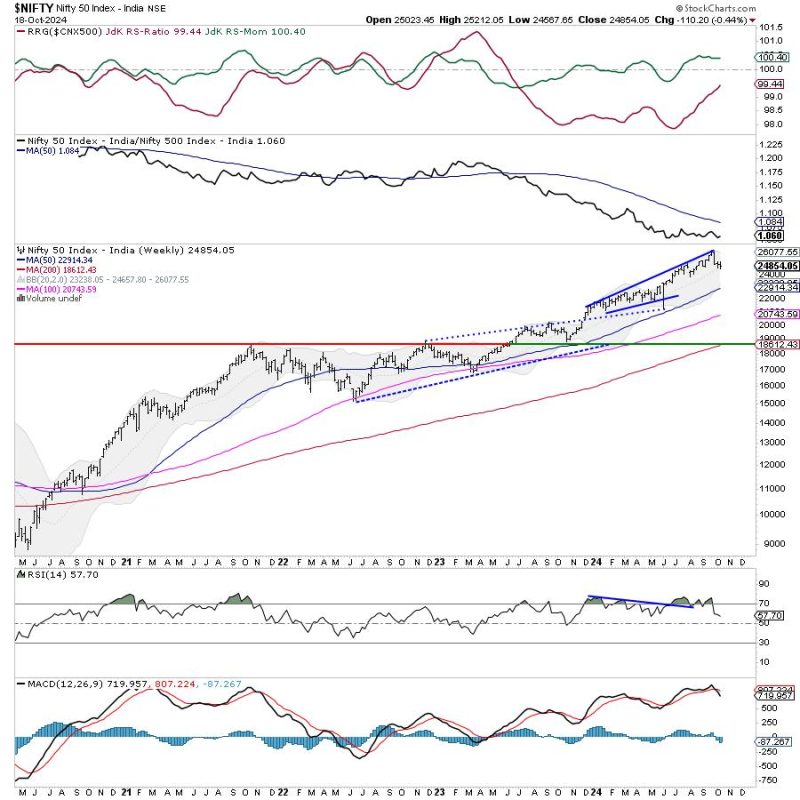

Technical analysis plays a crucial role in predicting market movements and trends. Traders and investors use various tools and indicators to analyze past data and identify potential future price movements. One such tool is the moving average, which helps in smoothing out price data to identify trends over a specific period. When the price moves above a moving average, it indicates a potential uptrend, while a move below suggests a possible downtrend.

In addition to moving averages, support and resistance levels also play a significant role in technical analysis. Support levels act as a barrier below the current price, preventing it from falling further, while resistance levels act as a ceiling above the current price, limiting its upward movement. When these levels are breached, they can signify potential trend reversals or continuations.

Another important indicator is the Relative Strength Index (RSI), which helps in identifying overbought or oversold conditions in the market. An RSI above 70 indicates that a stock may be overbought and could potentially see a reversal, while an RSI below 30 suggests oversold conditions and a potential price increase.

Moreover, chart patterns such as head and shoulders, triangles, and flags can provide valuable insights into future price movements. These patterns reflect the market psychology and can help traders anticipate potential breakouts or breakdowns.

It is essential for traders and investors to combine various technical indicators and tools to form a comprehensive analysis of the market. By paying attention to key levels, trends, and indicators, market participants can make informed decisions and manage risk effectively.

In conclusion, technical analysis is a valuable tool for predicting market trends and movements. By using moving averages, support and resistance levels, RSI, and chart patterns, traders can gain a better understanding of the market and make informed decisions. It is crucial to stay updated with the latest market developments and adapt strategies accordingly to navigate the dynamic world of trading successfully.