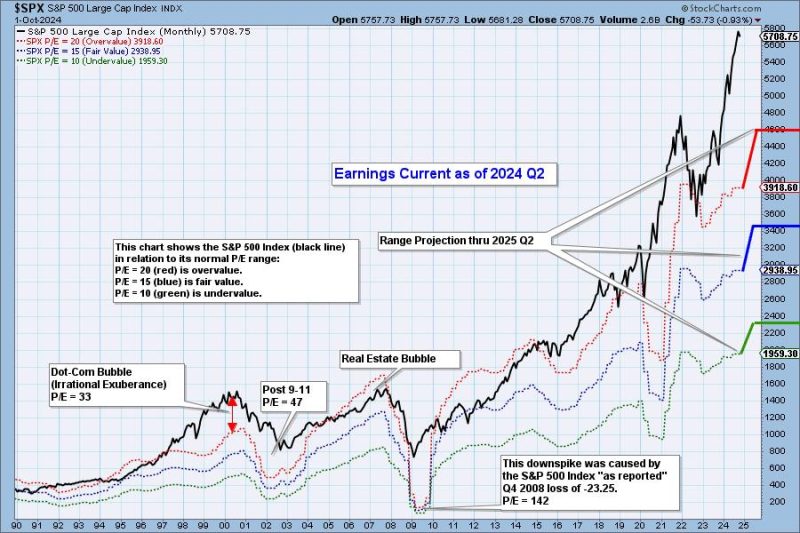

In a recent market analysis for the second quarter of 2024, concerns about the overvaluation of various sectors have been brought to light. Investors have been closely watching key indicators to gauge the health and sustainability of current market valuations, and the results have raised eyebrows across the financial landscape. As various economic factors continue to fluctuate, it is essential for investors to stay vigilant and be aware of the potential risks associated with an overvalued market.

One of the primary concerns highlighted in the analysis is the discrepancy between market valuations and underlying economic fundamentals. The disconnect between stock prices and actual company performance has led to a growing perception that certain sectors are trading at unjustifiably high levels. This poses a significant risk to investors, as it may indicate an impending market correction or potential bubble burst.

Additionally, the prevalence of speculative trading and market exuberance has further fueled concerns about the sustainability of current valuations. The rise of meme stocks, cryptocurrency volatility, and the proliferation of SPACs (Special Purpose Acquisition Companies) have all contributed to an environment where market prices are being driven more by hype and speculation rather than underlying fundamentals. This trend can create a precarious situation for investors, as it increases the likelihood of sudden market downturns and significant investment losses.

Furthermore, the impact of global economic uncertainties and geopolitical tensions cannot be underestimated in assessing market valuations. Factors such as trade disputes, inflationary pressures, supply chain disruptions, and political instability can all influence market sentiment and trigger volatility. As such, it is crucial for investors to remain informed about these external factors and their potential ramifications on market valuations.

Amidst these challenges, it is important for investors to adopt a prudent and cautious approach to managing their portfolios. Diversification, risk assessment, and a long-term investment perspective are key strategies to navigate through periods of market overvaluation. By conducting thorough research, monitoring economic developments, and maintaining a disciplined investment strategy, investors can better position themselves to weather potential market corrections and capitalize on long-term opportunities.

In conclusion, the analysis of the second-quarter 2024 earnings has shed light on the prevailing concerns regarding market overvaluation. It is imperative for investors to exercise caution, conduct thorough due diligence, and remain vigilant in assessing the underlying fundamentals of their investments. By staying informed, adopting a prudent investment approach, and being prepared for market uncertainties, investors can mitigate risks and make well-informed decisions in an environment where valuations may be inflated and vulnerable to sudden reversals.