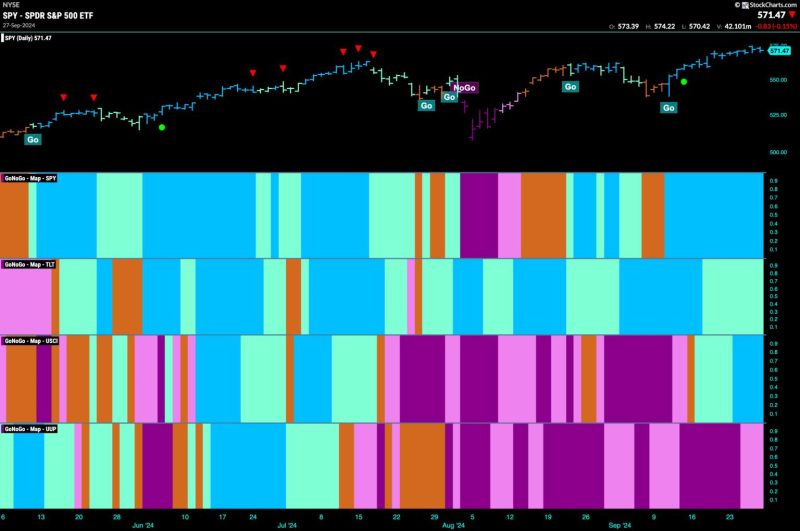

Equities Remain in Strong Go Trend as Communication Stocks Begin to Excel

The equity market continues its strong upward trend as communication stocks show signs of resilience and growth. The latest market analysis indicates that the momentum in the equities sector remains positive, driven in part by the performance of communication companies. This trend is particularly noteworthy as it reflects a broader theme of resilience and adaptability in the market amid ongoing economic challenges.

One of the key drivers of the strong performance of communication stocks is the increasing reliance on digital communication channels in the wake of the global pandemic. The shift towards remote work and virtual collaboration has led to a surge in demand for communication services, driving revenues and profits for companies operating in this sector. As a result, investors have shown renewed interest in communication stocks, viewing them as a safe and stable investment in an uncertain economic environment.

Another factor contributing to the strength of equities is the overall positive sentiment in the market. Despite lingering concerns about the pace of economic recovery and the potential impact of inflation, investors remain optimistic about the prospects for growth and earnings. This sentiment has translated into increased buying activity, pushing stock prices higher and driving the overall market trend.

Additionally, the continuing support from central banks and governments has played a crucial role in sustaining the upward momentum in equities. Monetary stimulus measures and fiscal support packages have helped to shore up investor confidence and provide a much-needed boost to the economy. The availability of cheap credit and favorable borrowing conditions have encouraged investment in equities, further fueling the positive trend in the market.

Looking ahead, the outlook for equities remains generally positive, with communication stocks expected to continue their strong performance. As the economy gradually recovers and businesses adapt to the new normal, the demand for communication services is likely to remain robust. This bodes well for companies operating in this sector and should support their earnings growth in the foreseeable future.

In conclusion, the current trend in equities reflects a combination of factors, including the resilience of communication stocks, positive market sentiment, and ongoing policy support. While challenges and uncertainties persist, the overall outlook remains optimistic, suggesting that the equity market is well positioned for continued growth. Investors should closely monitor developments in the communication sector and consider capitalizing on opportunities presented by the strong performance of these stocks.