In the rapidly changing landscape of the stock market, it is crucial for investors to stay informed and proactive in their decision-making. The recent indicators in the Nifty index have raised concerns about a potential disruption of the current uptrend. While market fluctuations are a common occurrence, it is essential for traders to exercise caution and adapt their strategies accordingly.

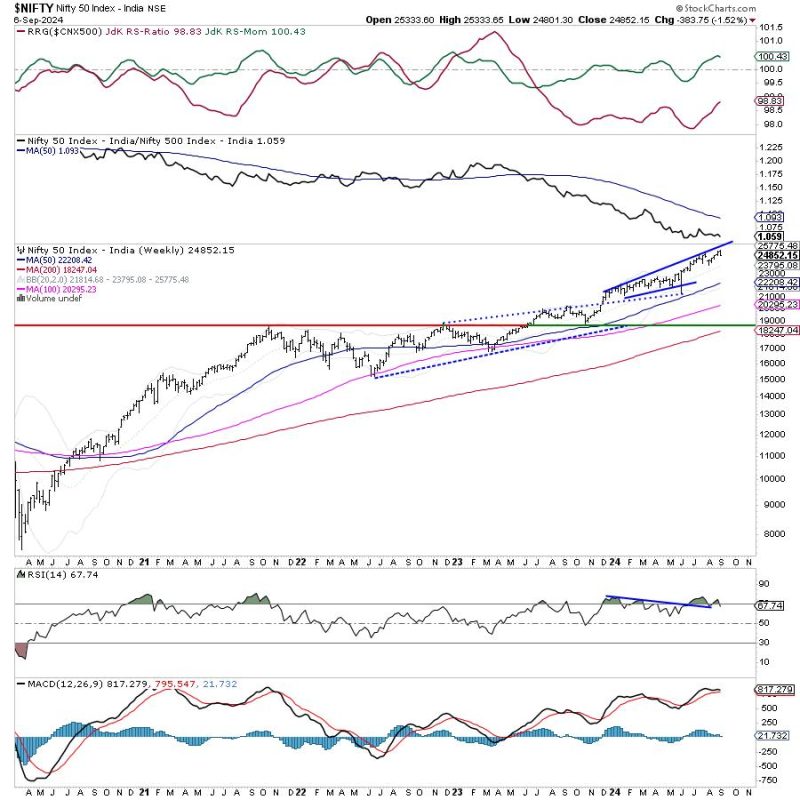

The Nifty index, which represents the performance of the top 50 companies listed on the National Stock Exchange of India, has shown early signs of a possible trend reversal. Technical analysis suggests that the index may be approaching a crucial support level, indicating a shift in momentum. Traders and investors should closely monitor these developments and be prepared to make timely adjustments to their positions.

In times of uncertainty, risk management becomes particularly important. Traders should consider implementing stop-loss orders to limit potential losses and protect their capital. Diversification of investments across different sectors and asset classes can also help mitigate risks associated with market volatility. By maintaining a well-balanced portfolio, investors can better withstand sudden market disruptions and achieve long-term financial goals.

Market sentiment and external factors, such as economic indicators and geopolitical events, can significantly influence stock prices. It is advisable for investors to stay informed about relevant news and developments that may impact the financial markets. Additionally, seeking guidance from financial experts or conducting thorough research can provide valuable insights and help investors make informed decisions.

While the current market conditions may pose challenges, they also present opportunities for astute traders to capitalize on potential trends. Strategic planning, disciplined trading practices, and a thorough understanding of market dynamics are essential for navigating uncertain times successfully. By staying vigilant and adaptable, investors can position themselves to weather market disruptions and emerge stronger in the long run.

In conclusion, the early signs of a likely disruption of the uptrend in the Nifty index serve as a reminder of the dynamic nature of financial markets. Traders should exercise caution, implement risk management strategies, and stay informed to navigate the changing landscape effectively. With careful planning and a proactive approach, investors can navigate market volatility and achieve their investment objectives.