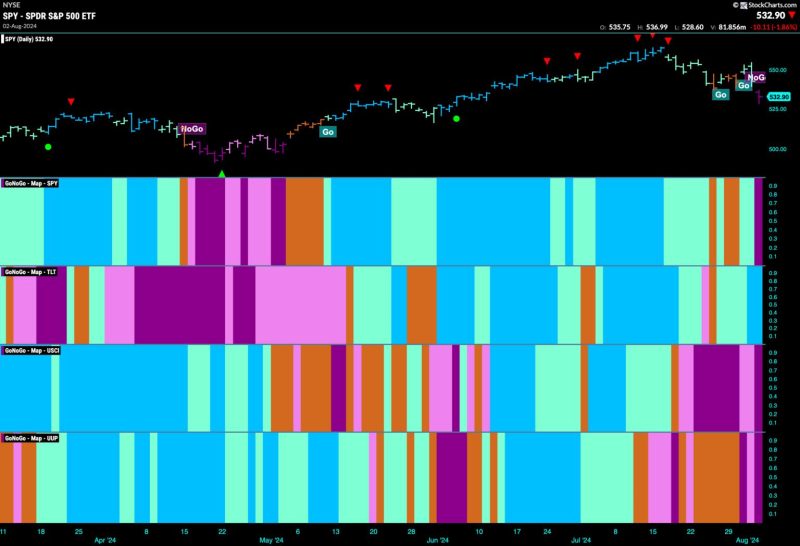

Stocks Get Defensive as Market Index Enters ‘NoGo’ Zone

The recent shift in market sentiment has investors on edge, with many turning to defensive stocks to navigate the turbulent waters of the financial markets. As the market index enters what analysts are dubbing the ‘NoGo’ zone, characterized by increased volatility and uncertainty, investors are seeking refuge in defensive sectors to shield their portfolios from potential downturns.

Defensive stocks, which include companies in industries such as healthcare, utilities, and consumer staples, are known for their stable earnings and resilience during economic downturns. These stocks tend to perform well in times of market turbulence, providing a buffer against volatility and offering investors a sense of security amidst uncertain market conditions.

The current market landscape, shaped by concerns over inflation, interest rate hikes, and geopolitical tensions, has prompted many investors to reconsider their investment strategies. With the Federal Reserve signaling a more hawkish stance on monetary policy and inflationary pressures on the rise, defensive stocks have emerged as a safe haven for investors looking to protect their capital.

Healthcare stocks, in particular, have garnered significant attention from investors seeking defensive options. The healthcare sector is known for its defensive qualities, with companies that provide essential services such as healthcare facilities, pharmaceuticals, and medical devices maintaining steady demand regardless of economic conditions. As the global population ages and healthcare spending continues to rise, healthcare stocks are seen as a reliable investment choice in uncertain times.

Utilities are another popular choice among investors seeking defensive stocks. Utility companies, which provide essential services such as electricity, water, and gas, are known for their stable revenues and predictable cash flows. These companies often have a regulated business model, offering investors a steady stream of income and reliable dividends even during economic downturns.

Consumer staples, including companies that produce everyday necessities such as food, beverages, and household products, are also considered defensive stocks. Consumer staples companies tend to have stable demand for their products, making them less susceptible to fluctuations in consumer spending and economic cycles. In times of uncertainty, investors often turn to consumer staples stocks as a safe investment option.

In conclusion, as the market index enters the ‘NoGo’ zone, investors are increasingly turning to defensive stocks to protect their portfolios from market volatility and economic uncertainties. With concerns over inflation and interest rates looming large, defensive sectors such as healthcare, utilities, and consumer staples offer investors a sense of stability and security in an otherwise turbulent market environment. By strategically allocating their portfolios to include defensive stocks, investors can navigate the choppy waters of the financial markets and position themselves for long-term success.