In the world of finance, navigating through the ups and downs of the market requires a keen understanding of various indicators and signals. One such indicator that has been gaining attention recently is the breadth indicator. This powerful tool provides insights into the overall market conditions and can be a valuable asset for investors and traders alike.

The breadth indicator measures the participation of stocks in a market advance or decline. In simple terms, it looks at how many individual stocks are moving in the same direction as the broader market. A high breadth indicator suggests that a large number of stocks are participating in the current trend, indicating strong market momentum. Conversely, a low breadth indicator signals a lack of participation, which may indicate a weaker market condition.

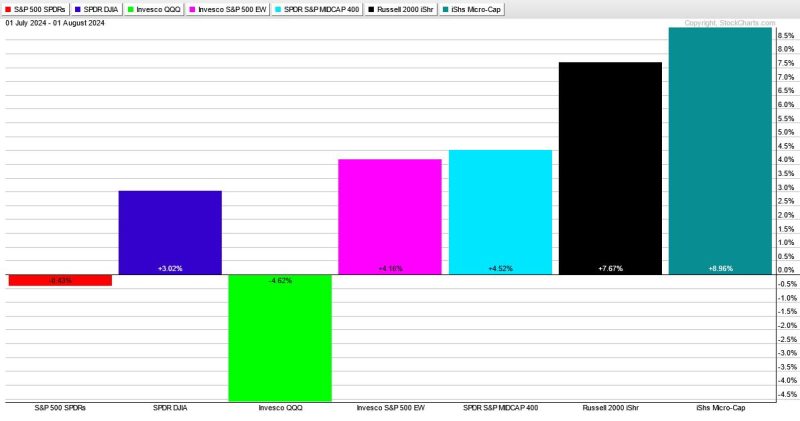

Currently, the breadth indicator is pointing towards more downside in the market. This implies that the recent market decline is not limited to just a few sectors or stocks but is more widespread across the board. While this may seem like a cause for concern for many investors, it is essential to remember that every market correction also presents opportunities for those who are prepared and strategic in their approach.

One potential opportunity that may arise from the market downturn indicated by the breadth indicator is the chance to buy high-quality stocks at a discounted price. When the market experiences a broad decline, even fundamentally strong companies can see their stock prices drop, creating an attractive buying opportunity for investors with a long-term perspective.

Additionally, the breadth indicator can help investors identify sectors or industries that are showing relative strength amid the market turmoil. By focusing on areas with high breadth indicators, investors can potentially find pockets of resilience that may outperform the broader market in the coming weeks or months.

It is important to note that while the breadth indicator can provide valuable insights into market conditions, it is just one of many tools in a comprehensive investment toolkit. It should be used in conjunction with other technical and fundamental analysis to make well-informed investment decisions.

In conclusion, the breadth indicator serves as a valuable tool for investors to gauge market participation and identify potential opportunities during market downturns. By understanding the signals provided by this indicator, investors can navigate through turbulent market conditions with confidence and make informed decisions that align with their investment objectives.