The 1-2-3 Reversal Pattern: A Powerful Tool for Traders

The 1-2-3 Reversal Pattern is a popular tool used by traders to predict potential reversals in the market. This pattern consists of three specific price movements that signal a potential trend reversal. Understanding this pattern can help traders make more informed decisions and improve their overall trading success.

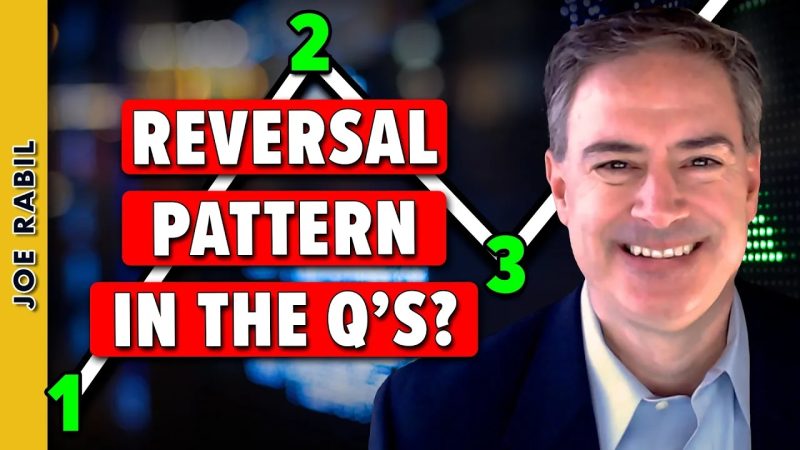

The first step in identifying a 1-2-3 Reversal Pattern is the initial trend. Traders must first identify a prevailing trend in the market. This trend can be an uptrend or a downtrend, depending on whether prices are moving higher or lower. Once the trend is established, traders can look for the first part of the pattern, which is a significant price movement in the opposite direction of the trend. This movement is known as Point 1.

After Point 1 has been established, the market will typically retrace back in the direction of the prevailing trend. This retracement forms Point 2 of the pattern. Point 2 should not breach the high or low of Point 1 but should come close to it. Point 2 acts as a confirmation that the market is retracing before potentially reversing.

The final step in the 1-2-3 Reversal Pattern is the breakout at Point 3. Once Point 2 is established, traders can look for the market to break past Point 2 and continue moving in the opposite direction of the initial trend. This breakout at Point 3 indicates a confirmed trend reversal and can be a signal to enter a trade in the new direction.

Traders can use the 1-2-3 Reversal Pattern in conjunction with other technical analysis tools to increase the probability of successful trades. It is essential to wait for confirmation of the pattern before entering a trade and to set appropriate stop-loss and take-profit levels to manage risk effectively.

In conclusion, the 1-2-3 Reversal Pattern is a valuable tool for traders looking to identify potential trend reversals in the market. By understanding the three key points of this pattern and using it in combination with other analysis techniques, traders can improve their trading performance and make more informed decisions. Implementing this pattern into your trading strategy can help you identify profitable opportunities and navigate market reversals with confidence.