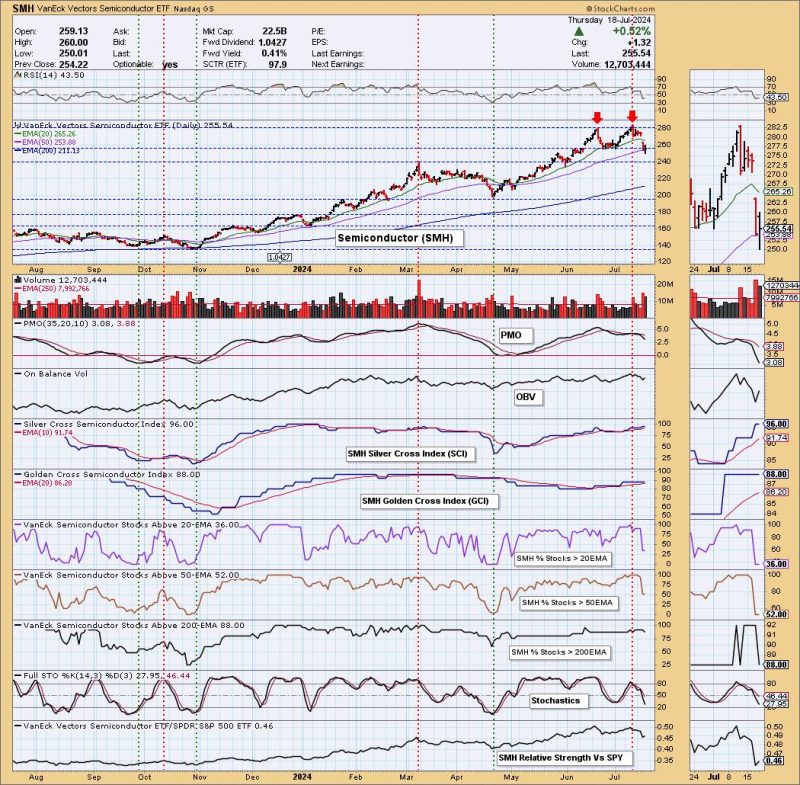

In a recent sector analysis report by GodzillaNewz, the phenomenon of a double top formation on the SMH semiconductor index was underscored. The double top pattern is a technical analysis chart pattern indicating a potential downward trend reversal in the market. It is characterized by two distinct peaks at a similar price level separated by a trough. This pattern tends to signal a shift in market sentiment from bullish to bearish, providing valuable insights to investors and traders.

Semiconductors play a pivotal role in the technology sector, with the SMH index serving as a key benchmark for the performance of semiconductor companies. The occurrence of a double top pattern on the SMH index suggests that investors may be losing confidence in the sector’s growth prospects. The first peak represents a significant high point where buyers are overwhelmed by sellers, resulting in a temporary price decline. Subsequently, a minor recovery may ensue, leading to the formation of the second peak, indicating a failed attempt to surpass previous highs.

The trough that separates the two peaks signifies a crucial support level that, once breached, could trigger a more pronounced downward movement. Technical analysts often look for confirmation signals to validate the double top pattern, such as a breakout below the support level or a significant increase in trading volume. These signals serve as early indicators of a potential trend reversal and allow market participants to adjust their investment strategies accordingly.

Investors and traders can capitalize on the insights provided by the double top pattern by adopting various trading strategies. For instance, short-selling positions can be initiated once the support level is breached, with stop-loss orders placed above the second peak to manage risk. Additionally, options strategies such as buying put options or employing bearish spreads can be utilized to profit from anticipated price declines in the semiconductor sector.

It is important to note that technical analysis tools such as the double top pattern should not be used in isolation but rather in conjunction with other indicators and fundamental analysis. Market conditions and external factors can influence price movements, and a holistic approach to investing is crucial for making informed decisions.

In conclusion, the identification of a double top pattern on the SMH semiconductor index serves as a valuable warning sign for investors and traders. By understanding the implications of this technical chart pattern and employing appropriate risk management strategies, market participants can navigate volatile market conditions more effectively and capitalize on potential profit opportunities in the semiconductor sector.