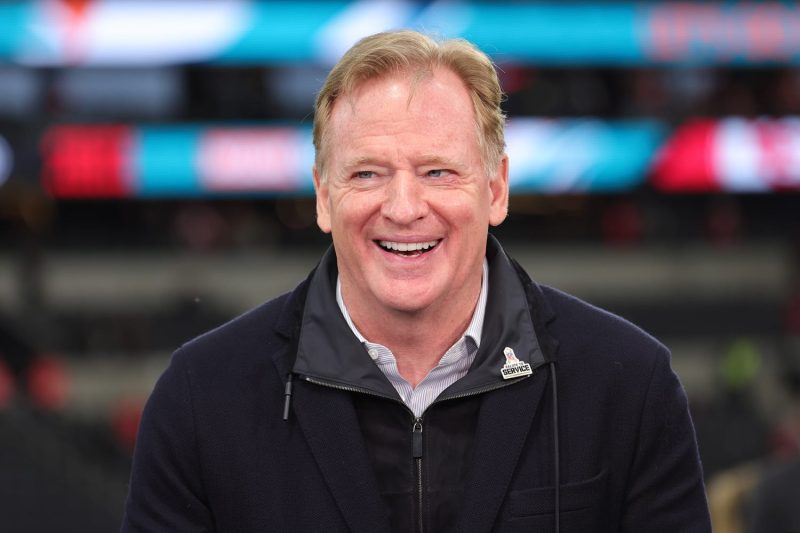

The recent announcement by NFL commissioner Roger Goodell regarding the league’s openness to private equity team ownership has stirred both curiosity and debate among football fans and business enthusiasts alike. This potential shift in ownership structure could have significant implications for the future of the NFL and the sports industry as a whole.

Private equity firms are known for their financial acumen and ability to drive growth and profitability in the companies they invest in. By allowing private equity ownership of up to 10% of NFL teams, the league could potentially attract high-profile investors who bring new perspectives and resources to the table. This could lead to increased capital injections, improved team performance, and enhanced fan engagement experiences.

However, this move also raises concerns about the potential impact of private equity ownership on the values and traditions that have long defined the NFL. The league has a rich history and deep-rooted fan base that values the unique culture and competitiveness of American football. Introducing private equity investors into team ownership could potentially prioritize profit-making over the core values that fans hold dear.

One of the key potential benefits of private equity ownership in the NFL is the possibility of injecting additional capital into teams, allowing them to invest in infrastructure, player development, and fan experience initiatives. Private equity investors could bring fresh perspectives and innovative strategies to the table, helping teams navigate the complex business landscape of professional sports and adapt to changing market dynamics.

On the flip side, private equity ownership could also lead to concerns about short-term financial motivations trumping long-term strategic planning. Private equity firms are known for their focus on maximizing returns on investment within a specific time frame, which could clash with the more traditional, long-term approach to team ownership in the NFL. This could potentially result in decisions that prioritize financial gains over the overall health and sustainability of the league.

Moreover, the introduction of private equity ownership could also raise issues related to governance, transparency, and accountability. The NFL has strict ownership rules and guidelines in place to ensure fair competition and uphold the integrity of the sport. Allowing private equity firms to own a stake in teams could potentially complicate the governance structure and decision-making processes within the league, leading to conflicts of interest and challenges in upholding the league’s values and standards.

In conclusion, while the NFL’s openness to private equity team ownership presents exciting opportunities for growth and innovation, it also raises several important considerations that must be carefully evaluated. As the league continues to explore this potential shift in ownership structure, it is crucial to strike a balance between embracing new perspectives and safeguarding the fundamental values and traditions that have made the NFL a beloved institution for fans around the world.