This article will provide insights into the market trends for the week ahead based on the analysis presented in the reference link. The focus will be on understanding the market sentiment and identifying stocks with strong relative strength for potential investment opportunities.

### Market Overview

The market is expected to remain tentative in the upcoming week, with investors closely monitoring key economic indicators and global events that may impact stock prices. Uncertainties surrounding geopolitical tensions, inflation concerns, and the evolving COVID-19 situation continue to influence market dynamics.

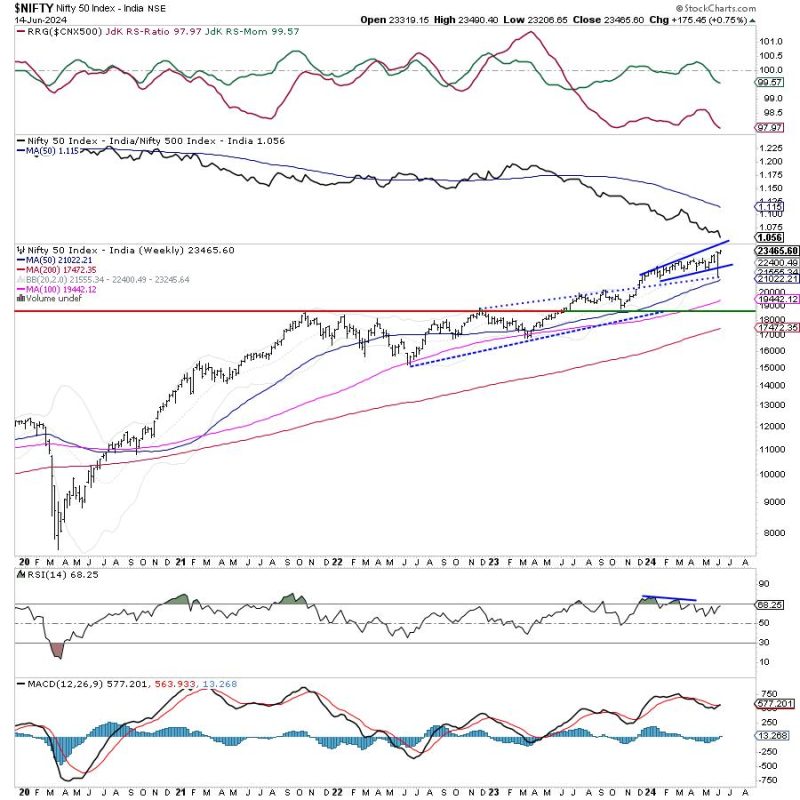

### Technical Analysis

Technical analysts suggest that Nifty may show a mixed performance, reflecting the broader sentiment of cautious optimism. Traders are advised to be agile in their trading strategies, considering both long and short positions to navigate potential market fluctuations effectively.

### Sector Analysis

It is essential to focus on sectors displaying strong relative strength in the current market environment. Industries like technology, healthcare, and consumer goods have shown resilience amidst market turbulence and may present lucrative investment opportunities for traders seeking stable returns.

### Stock Selection Criteria

When selecting stocks for investment, it is recommended to choose those with robust relative strength compared to their industry peers. Identifying companies with sound fundamentals, consistent growth prospects, and efficient management can enhance the probability of maximizing returns and minimizing risks.

### Risk Management

In volatile market conditions, risk management plays a pivotal role in preserving capital and maximizing returns. Traders should establish clear stop-loss levels, diversify their portfolios, and refrain from emotional trading decisions to mitigate potential losses and capitalize on profitable opportunities.

### Market Sentiment

Understanding market sentiment is crucial for making informed investment decisions. By analyzing macroeconomic trends, fiscal policies, and corporate earnings reports, traders can gain valuable insights into market movements and adjust their strategies accordingly to adapt to changing market conditions.

### Conclusion

As the market enters a period of uncertainty, maintaining a cautious yet opportunistic approach towards investing is prudent. By staying informed about market developments, adhering to risk management practices, and focusing on stocks with strong relative strength, traders can navigate market volatility successfully and potentially capitalize on emerging opportunities for profitable trading outcomes.