Sector Rotation Model Flashes Warning Signals: What Investors Need to Know

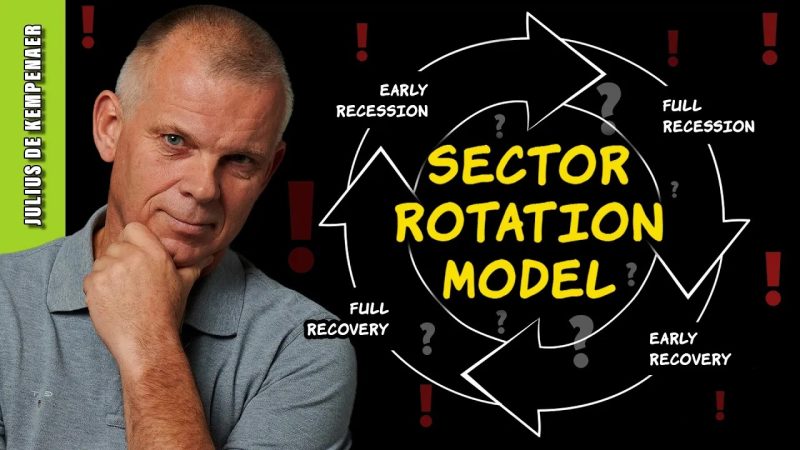

The strategy of sector rotation is a popular method used by investors to profit from the cyclical nature of the stock market. By identifying sectors that are poised to outperform or underperform based on the current economic environment, investors can adjust their portfolios accordingly to capitalize on potential opportunities. However, the sector rotation model is not foolproof and can sometimes signal warning signs that investors need to be aware of.

One key indicator in the sector rotation model is the relative strength of various sectors compared to the broader market. When certain sectors are consistently outperforming or underperforming the market as a whole, it can provide valuable insights into the direction of the market. In recent times, the model has been flashing warning signals as some traditionally strong sectors have started to underperform.

For example, the technology sector, which has been a powerhouse in recent years, has shown signs of weakening relative strength. This could be a cause for concern for investors who have heavily weighted their portfolios towards technology stocks. Similarly, defensive sectors like consumer staples and utilities have been lagging behind, indicating a shift in investor sentiment towards more cyclical sectors.

Another aspect of the sector rotation model is the analysis of economic indicators and market trends to determine which sectors are likely to perform well in different market conditions. For example, during economic downturns, defensive sectors like healthcare and consumer staples tend to outperform, while cyclical sectors like industrials and materials struggle. By keeping a close eye on these indicators, investors can position themselves for success in any market environment.

However, the sector rotation model is not without its limitations. One of the key challenges is the unpredictability of the market, which can quickly change course and invalidate the signals provided by the model. In addition, sector rotation requires active management and constant monitoring of market conditions, which may not be suitable for all investors.

In conclusion, while the sector rotation model can be a valuable tool for investors looking to capitalize on market trends and economic cycles, it is important to approach it with caution. By understanding the warning signals and limitations of the model, investors can make more informed decisions and navigate the complexities of the stock market more effectively. Ultimately, a well-diversified portfolio that takes into account a variety of factors, including sector rotation, is key to long-term investment success.