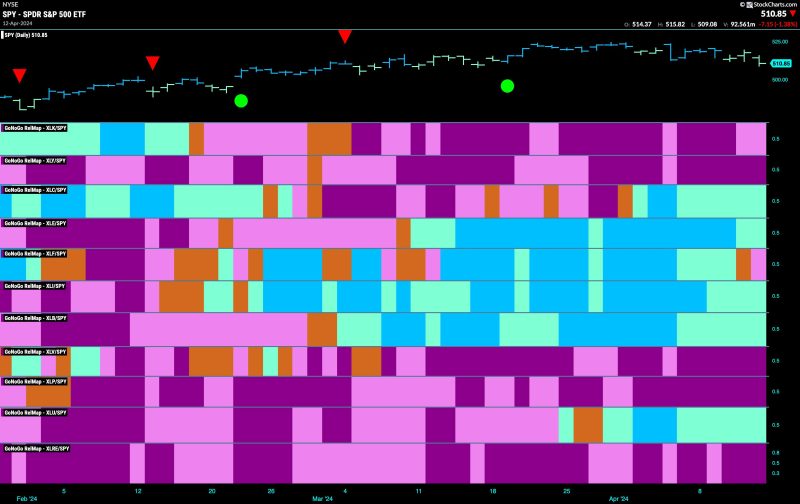

Equity Markets Struggle to Hold Onto Go Trend as Industrials Try to Lead – Apr 15, 2024 article provides a detailed analysis of the current situation in the global financial markets. Here, we will delve deeper into the factors influencing the market trends, particularly focusing on the struggles faced by equity markets and the efforts of industrial sectors to lead the way.

**Global Market Overview:**

The article highlights the volatile nature of equity markets, with a struggle to hold onto the prevailing trends. This scenario is not uncommon in the financial realm, where market sentiment, economic indicators, and geopolitical events often collide to shape the direction of stock exchanges worldwide. Investors and traders grapple with uncertainties, seeking opportunities amidst the turbulent environment.

**Industrial Sectors Taking the Lead:**

One noteworthy aspect emphasized in the article is the resilient performance of industrial sectors in attempting to lead the market despite the challenges. Industrial companies play a pivotal role in the economy, providing essential goods and services, and driving infrastructure development. Their ability to weather market fluctuations showcases their adaptability and strategic positioning in the current economic landscape.

**Macro Trends and Impacts:**

The article touches upon macroeconomic trends influencing market dynamics, such as inflation, interest rates, and trade policies. These factors have a significant impact on investment decisions and can either propel or hinder market growth. Indicators like consumer spending, manufacturing output, and job reports also contribute to the overall market sentiment and investor confidence.

**Tech Sector Contrasts:**

Another notable point raised in the article is the contrasting performance of the tech sector compared to industrials. Technology companies, known for their innovation and disruption, face their own set of challenges amidst shifting consumer preferences, regulatory pressures, and market saturation. The divergence in sector performance reflects the nuanced nature of the market, where different industries navigate distinct obstacles.

**Investor Strategies and Risk Management:**

In light of the market uncertainties outlined in the article, investors are advised to adopt prudent strategies and robust risk management practices. Diversification, asset allocation, and staying informed about market developments are crucial in mitigating risks and maximizing returns. Long-term investment goals should align with a balanced portfolio tailored to individual risk tolerance and financial objectives.

**Conclusion:**

In conclusion, the Equity Markets Struggle to Hold Onto Go Trend as Industrials Try to Lead – Apr 15, 2024 article sheds light on the intricate interplay of factors shaping global financial markets. Amidst the challenges faced by equity markets, industrial sectors emerge as a beacon of stability and resilience. Investors navigating the tumultuous market waters must remain vigilant, informed, and adaptable to seize opportunities and safeguard their investment portfolios in a dynamic economic landscape.