The ATR Trailing Stop: An Essential Tool for Managing Trades and Defining Trends

Understanding how to effectively manage trades and identify trends is crucial for successful trading in the financial markets. With the plethora of tools and indicators available to traders, one that stands out for its simplicity and effectiveness is the Average True Range (ATR) Trailing Stop.

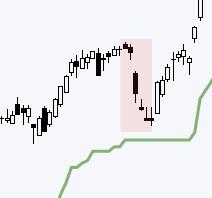

The ATR Trailing Stop is a trend-following indicator that helps traders manage their trades by providing dynamic levels of support and resistance. Unlike fixed indicators, the ATR Trailing Stop adjusts to market conditions, making it a valuable tool for both new and experienced traders.

By using the ATR Trailing Stop, traders can define the trend direction and manage their trades more effectively. The indicator calculates the average true range of price movements over a specified period, providing a measure of the volatility in the market.

One of the key aspects of the ATR Trailing Stop is its ability to adjust to changing market conditions. As volatility increases, the ATR value rises, leading to wider trailing stop levels. Conversely, in low-volatility periods, the trailing stops tighten, allowing traders to lock in profits and minimize losses.

Traders can use the ATR Trailing Stop in various ways, depending on their trading style and risk tolerance. For trend followers, the indicator helps identify the prevailing trend and provides entry and exit signals based on trailing stop levels. Traders can use the ATR Trailing Stop to place stop-loss orders, trailing stops, and take-profit levels, ensuring that they follow the trend and maximize profits.

Additionally, the ATR Trailing Stop can be used in conjunction with other technical indicators to confirm trade signals and avoid false breakouts. By combining the ATR Trailing Stop with indicators like moving averages, RSI, or MACD, traders can increase the accuracy of their trading signals and improve their overall performance.

In conclusion, the ATR Trailing Stop is a versatile and powerful tool that can help traders manage their trades and define trends effectively. By incorporating this indicator into their trading strategy, traders can enhance their decision-making process, minimize risks, and improve their profitability in the financial markets. Whether you are a novice trader or an experienced investor, the ATR Trailing Stop offers a simple yet effective way to navigate the complex world of trading with confidence and success.